Maintenance and Repairs in NNN Leases: A Comprehensive Guide for Nonprofit Tenants

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

Are nonprofit tenants responsible for property repairs in triple net leases? How do maintenance costs affect NNN lease agreements? If you’re a nonprofit organization considering leasing commercial space, understanding your maintenance and repair responsibilities is essential for budgeting and long-term planning.In a triple net lease (NNN lease), tenants are typically responsible for paying property insurance, property taxes, and maintenance costs. But what does this mean in terms of specific maintenance tasks and associated costs? Let’s delve into the details to demystify NNN lease maintenance and help you make informed decisions.

Key Takeaways:

- Triple net leases (NNN leases) require nonprofit tenants to take on property maintenance responsibilities.

- Maintenance costs in NNN leases include routine repairs as well as recurring and non-recurring expenses.

- Understanding NNN lease maintenance can help nonprofit tenants effectively budget and plan for long-term property upkeep.

- NNN leases incentivize tenants to maintain the property, leading to cleaner and well-maintained spaces.

- Working with experienced professionals can ensure nonprofit tenants navigate the complexities of NNN lease agreements.

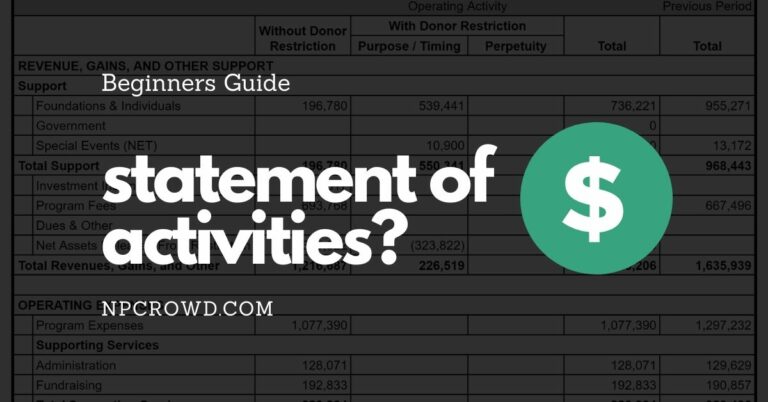

What Are NNNs and How Are They Calculated?

A triple net lease (NNN lease) is a type of lease agreement in commercial real estate where tenants are responsible for paying their pro-rata share of expenses associated with common-area maintenance (CAMs), property taxes, and insurance. This type of lease structure places the financial responsibility on the tenant rather than the landlord.

To calculate triple nets, the total expenses for the year are divided by the rentable square footage of the building. The result is then divided by 12 to get the monthly amount. Tenants are required to pay their base rent along with the estimated monthly triple net amount. It’s important to note that the actual costs incurred may differ from the estimate, so a CAM Reconciliation is performed at the end of each year to adjust the payments accordingly.

This image illustrates the concept of NNN leases and how they are calculated. The rentable square footage plays a crucial role in determining the tenant’s share of expenses. The larger the space, the higher the triple net amount.

What Do NNNs Cover?

Triple net leases (NNNs) specifically cover common-area maintenance expenses, which encompass both recurring and non-recurring work performed on shared spaces and utilities within the property. These expenses are crucial for ensuring the proper upkeep and functionality of the common areas that all tenants benefit from.

The coverage of NNNs can be divided into two main categories: recurring expenses and non-recurring expenses.

Recurring Expenses

Recurring expenses included in NNNs typically consist of routine services and ongoing maintenance activities necessary to keep the property in good condition. Some common examples of recurring expenses covered by NNNs include:

- Day-porter service

- Property management

- Trash removal

- Electricity bills

These expenses are recurring because they are required on a regular basis to ensure that the common areas are clean, well-maintained, and functioning properly. By including these expenses in the NNNs, tenants share the responsibility and cost of maintaining a pleasant and functional environment for everyone.

Non-Recurring Expenses

In addition to recurring expenses, NNNs also cover non-recurring expenses, which are typically associated with repairs and replacements for specific items within the common areas. These expenses arise from unexpected or infrequent needs and may include:

- Parking lot pothole repairs

- Light fixture replacements

- Sprinkler repairs

Non-recurring expenses can vary depending on the property, but they are generally necessary for addressing maintenance issues and ensuring the safety and functionality of shared spaces.

It’s important to note that while NNNs typically cover most common-area maintenance expenses, the responsibility for certain costs may still lie with the landlord. For example, expenses related to the foundation, structural elements, and roof may be the landlord’s responsibility in some cases.

By sharing the costs of common-area maintenance, NNNs create a fair and balanced arrangement that benefits all tenants.

| Expense Category | Examples |

|---|---|

| Recurring Expenses |

|

| Non-Recurring Expenses |

|

Benefits of NNN Leases

NNN leases offer several benefits that make them an attractive option for both tenants and landlords. Let’s take a closer look at these advantages:

Lower Base Rent

One of the key benefits of NNN leases is the lower base rent. With NNN leases, tenants are responsible for paying additional triple net costs, which include property taxes, insurance, and maintenance expenses. By shifting these costs to tenants, landlords can keep the base rent lower, making the lease more affordable for tenants. This lower base rent can be a major draw for potential tenants, increasing the demand for the property.

Tenant Responsibility

In NNN leases, tenants have a vested interest in the property’s maintenance and upkeep. As tenants are responsible for paying the property’s operating expenses, they are incentivized to take good care of the common areas. This results in cleaner, well-maintained properties that enhance the overall appeal and value of the property. With tenants actively participating in the property’s upkeep, landlords can focus on other aspects of property management, leading to a more streamlined process.

Stable Investments

NNN leases are considered stable investments in the commercial real estate market. The responsibility placed on tenants to cover the property’s operating expenses, such as taxes, insurance, and maintenance, reduces the landlord’s financial risk. The stability and predictability of NNN leases make them attractive to lenders, who are more likely to offer favorable loan terms to investors. Additionally, when it comes time to sell the property, NNN leases can make the process smoother and more straightforward, as potential buyers are drawn to the stability and long-term income provided by these leases.

Longer-Term Leases

With NNN leases, changes in operating expenses are shared between the tenant and the landlord. As a result, tenants are more likely to commit to longer-term leases, as they can anticipate and plan for potential increases in expenses. This stability benefits both the tenant and the landlord, as longer leases provide a steady income stream for landlords and a secure location for tenants to grow their business. By encouraging longer-term leases, NNN leases contribute to a more stable and prosperous business environment.

Lower Turnover Rates

Another advantage of NNN leases is the lower turnover rates they typically offer. Since tenants are responsible for repairs within their own rentable space, they have more control over the condition and maintenance of their premises. This can reduce the likelihood of major issues arising and the need for frequent turnover. The decreased turnover benefits both tenants and landlords, as it reduces the costs associated with finding new tenants and maintaining vacant spaces.

Overall, NNN leases provide significant benefits to both tenants and landlords. The lower base rent, tenant responsibility for common areas, stable investments, longer-term leases, and lower turnover rates make NNN leases an attractive option in the commercial real estate market.

| Benefits of NNN Leases |

|---|

| Lower base rent |

| Tenant responsibility for common areas |

| Stable investments |

| Encourages longer-term leases |

| Lower turnover rates |

Other Lease Elements in NNN Leases

NNN leases not only encompass the payment of property maintenance, taxes, and insurance costs but also include other lease elements that can benefit tenants. These additional incentives can provide financial relief and flexibility, making NNN leases more appealing for nonprofit and commercial tenants.

Tenant Improvement Allowance

One significant lease element in NNN leases is the tenant improvement allowance. This provision allows tenants to receive funds from the landlord to customize or renovate the leased space according to their specific needs. The tenant improvement allowance can cover expenses such as construction, renovations, or installing fixtures, ensuring the space is tailored to the tenant’s requirements.

Free Rent

Another attractive lease element is free rent, wherein tenants are granted a designated period of rent-free occupancy. This incentive allows tenants to allocate their financial resources towards settling into the space, purchasing furniture, equipment, or other necessities. Free rent provides temporary relief from the financial burden of paying rent in the initial months of the lease term.

Lease Incentives

In addition to tenant improvement allowance and free rent, NNN leases may involve other lease incentives aimed at attracting and retaining tenants. These incentives can include discounted rent, rent abatement, or reduced operating expenses for certain periods. The specific terms and conditions of these incentives vary depending on the negotiations between the tenant and the landlord.

When entering into an NNN lease agreement, it is crucial for tenants to thoroughly understand and carefully negotiate these lease elements. Properly utilizing tenant improvement allowances and taking advantage of free rent and other lease incentives can significantly benefit tenants, providing financial flexibility, and enhancing the overall leasing experience.

| Lease Element | Description |

|---|---|

| Tenant Improvement Allowance | Funds provided by the landlord for customizing or renovating the leased space. |

| Free Rent | A designated period of rent-free occupancy. |

| Lease Incentives | Other incentives offered by the landlord, such as discounted rent or rent abatement. |

Conclusion

NNN leases play a significant role in commercial real estate, particularly for nonprofit tenants. These leases shift the responsibility of property maintenance, taxes, and insurance costs to the tenant. By understanding the calculation and coverage of triple nets, nonprofit tenants can make more informed decisions when negotiating lease agreements.

One of the key advantages of NNN leases is the lower base rent, as the additional triple net costs are shared among all tenants. This can attract more nonprofit tenants who are looking for cost-effective leasing options. Furthermore, NNN leases incentivize tenants to take care of common areas, resulting in cleaner and well-maintained properties.

Nonprofit tenants should also consider other lease elements, such as tenant improvement allowances and free rent. These incentives can provide financial support for building out the space and reduce initial rental costs. Partnering with experienced professionals throughout the leasing process can ensure a smooth and successful experience for nonprofit tenants.

Overall, NNN leases offer nonprofit tenants an opportunity to secure stable and affordable lease agreements. By familiarizing themselves with the NNN lease guide and understanding the maintenance responsibilities associated with these leases, nonprofit tenants can make the most out of their commercial real estate investments.

FAQ

What is a triple net lease (NNN lease) and how are they calculated?

A triple net lease is a type of commercial real estate lease where tenants are responsible for paying property insurance, property taxes, and maintenance costs. NNNs are calculated by projecting the total expenses for the year and dividing it by the total rentable square footage of the building.

What expenses do NNNs cover?

NNNs specifically cover common-area maintenance expenses, which include routine and non-routine work performed on shared spaces/utilities of the property. This can include services like day-porter service, property management, trash removal, and electricity bills.

What are the benefits of NNN leases?

NNN leases offer several benefits, including lower base rent, tenant responsibility for maintenance, cleaner and well-maintained properties, incentives for longer-term leases, and stable investments resulting in better loan terms and easier selling processes.

How do triple net lease structures differ from other lease structures?

In a triple net lease, tenants pay for operating expenses in addition to their base rent, whereas in a gross lease structure, the landlord pays for operating expenses. Full-service leases include operating expenses in a predetermined rate, while single net leases only require payment for property taxes, and double net leases include property taxes and insurance.

What other lease elements can be included in NNN leases?

NNN leases can include additional elements like a tenant improvement allowance, which provides funds for building out the space, and free rent, where the tenant receives a few months of rent at no cost. These incentives typically apply to base rent and do not cover operating expenses.

What should nonprofit tenants consider when navigating NNN leases?

Nonprofit tenants should understand the calculation and coverage of triple nets, as well as the benefits and other lease elements. It’s important to negotiate and clarify elements like tenant improvement allowances and free rent, and working with experienced professionals can help ensure a smooth leasing process.