Exploring The Statement of Activities: A Beginner’s Guide

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

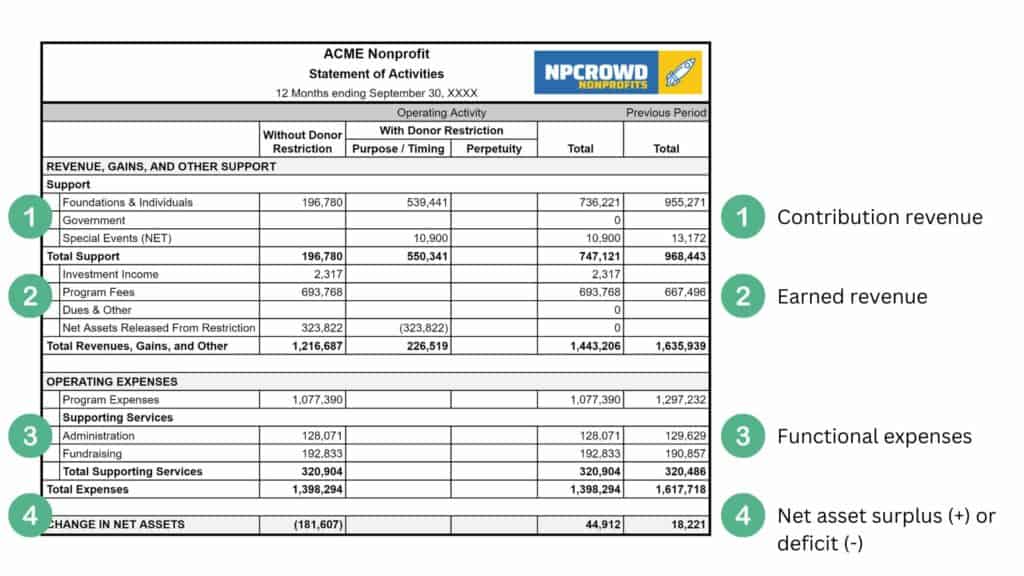

A Statement of Activities, also called a Profit & Loss Statement, is a financial report that shows how much a nonprofit organization earned or spent over a period of time, typically one year. The statement can be used to track the organization’s progress and make sure it is meeting its financial goals.Reading a Statement of Activities can be helpful for understanding a nonprofit’s overall financial picture. This guide will explain what a Statement of Activities is and the key components in it.

What is a Statement Of Activities in a Nonprofit

Out of the four most common financial statements in a nonprofit, the Statement of Activities, also known as the Profit & Loss (P&L), is the broadest. The P&L covers all the organization’s programmatic, fundraising, and administrative expenses incurred during the period. The statement also reports all the revenue generated during the period, regardless of the source.

The P&L is important because it provides a high-level overview of how much money the nonprofit is bringing in and where it is being spent. This information can be used to make decisions about where to allocate resources and how to improve the organization’s financial health.

LEARN MORE: Can you read the four critical financial statements of a nonprofit? Read our no BS beginners guide to nonprofit financial management. While eating your lunch, you’ll walk away knowing the basics. Give it a quick read.

How To Read A Statement Of Activities

There are three key areas to understand when reading a Statement of Activities: purpose, components, and terms. Let’s dig a bit more into each one.

Purpose

The first step in reading a Statement of Activities is to understand its purpose.

A Statement of Activities shows whether an organization made a profit or a loss during a period of time. It is a financial snapshot that can be used to track the organization’s financial progress.

This report is helpful for nonprofits because it provides a clear picture of how the organization is generating and using its resources to further its mission.

Components of the Statement of Activities

The second step is to understand the components of a Statement of Activities.

There are three main sections: revenue, expenses, and net income.

Revenue : How Much Money You Received

Revenue is the money coming into the organization. It can be from any number of sources. We typically break revenue into two categories; contributed and earned.

Contributed revenue (Contribution or Support) is derived from supporting sources like: donations, grant, and special events.

Earned revenue comes from activities your organization performs and therefore has earned. These source include:

- Program fees

- Membership dues

- Fee-for-service/Contracts

- Ticket Sales

- Investment Income

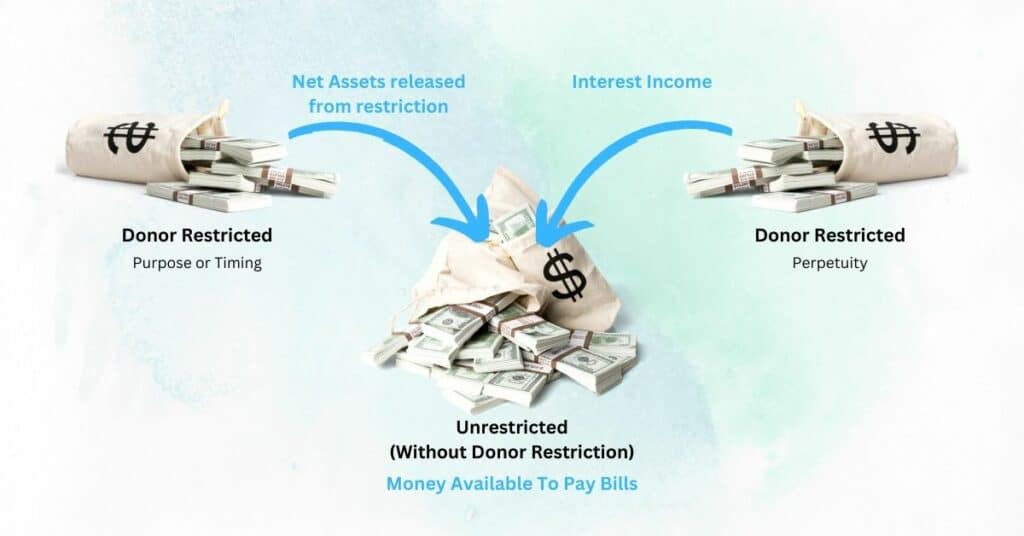

Restricted vs. Unrestricted Revenue

Revenue is broken down into two categories in order to comply with GAAP guidelines:

- Unrestricted

- Restricted

Unrestricted revenue is money that can be used for any purpose. These are monies an organization uses to pay bills.

Restricted revenue is money that can only be used for specific purposes or at a specified time. It is not available to pay bills.

For example, a grant for a new playground would be considered restricted revenue as the funds can only be used for expenses for the new playground.

A donor could give a single donor that is to equally be split across 3 years. We consider that there is a time restriction on the funds allowing only 1/3 of the donation to become unrestricted in a given year.

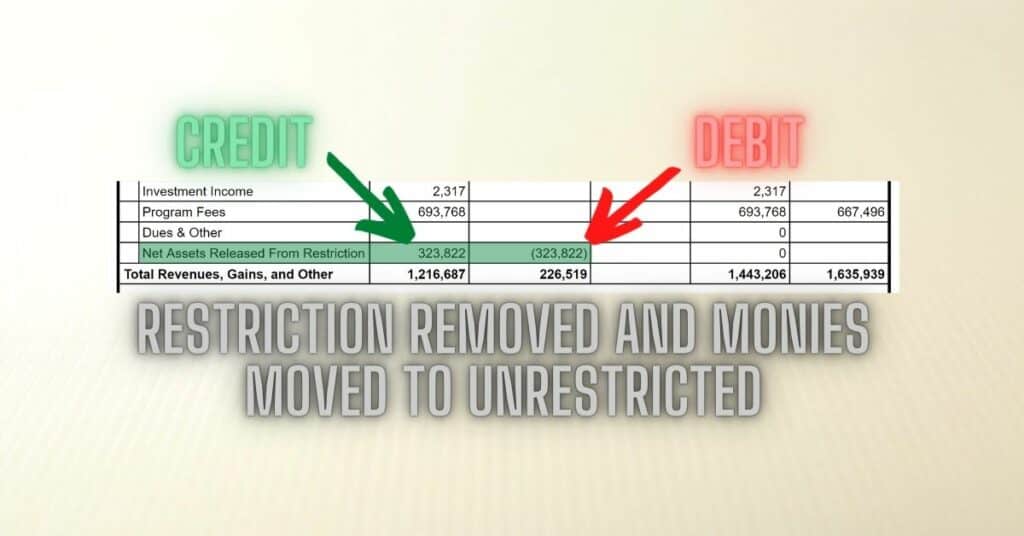

It is important to see the distinction between restricted and unrestricted as only unrestricted revenue can be used to pay bills. When a restriction is satisfied, those monies are moved from restricted to unrestricted and then used for expenses.

This movement can be seen in the “Net Assets Release From Restriction” line of the Statement of Activities

Expenses

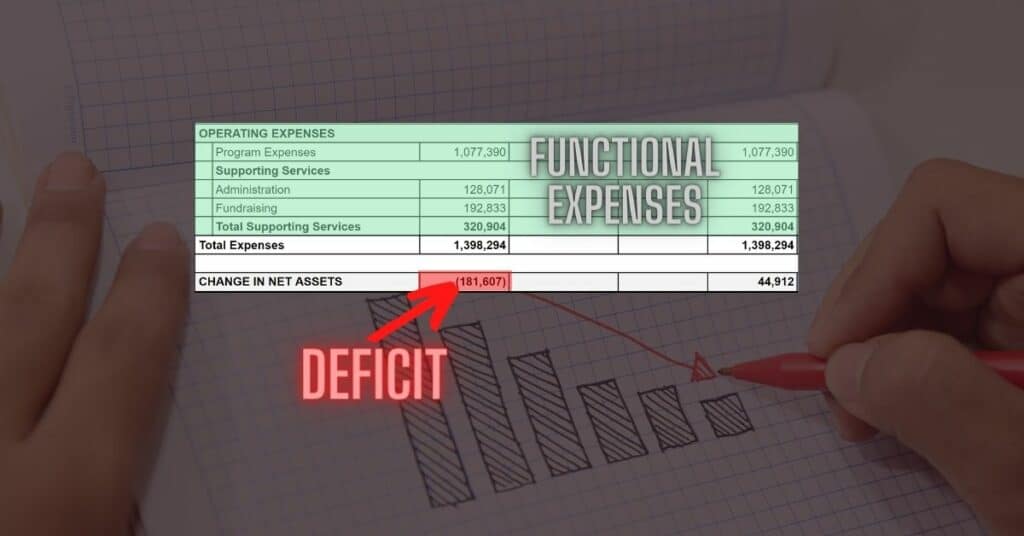

Expenses in the Statement of Activities include all money flowing out of your organization.

Think of things like paying bills, payroll, and office supplies. But also, things like programmatic expenses, or the cost of holding events should be included. These payments may have been made with cash, credit, or even through in-kind donations.

Expenses can be summarized into high-level categories or broken into specific accounts or classes.

However, given the importance placed on the allocation of functional expenses in nonprofits, some statements of activities will provide this functional breakdown into:

- Program expenses: expenses related to the activities of a specific program

- Administration/Management expenses: “overhead” expenses

- Fundraising expenses: expenses specific to fundraising activities

Net Income

The first thing you’ll want to look at when reading a nonprofit statement of activities is the net income. This will give you an idea of whether or not the organization is bringing in more money than it’s spending.

If the net income is positive, that means the organization is making more money than it’s spending. This is a good thing! It means the organization is doing well and is able to continue its operations. That’s called a profit.

If the net income is negative, that means the organization is spending more money than it’s making. This is not a good thing and the organization may have difficulty continuing its operations in the long run. This is called a loss.

Key Terms

The third step is to understand the key terms. Here are some key terms you will see on a Statement of Activities:

- Revenue: all the money the organization took in during the period

- Expenses: all the money that the organization spent during the period

- Net income: the difference between income and expenses

- Profit: when net income is positive

- Loss: when net income is negative

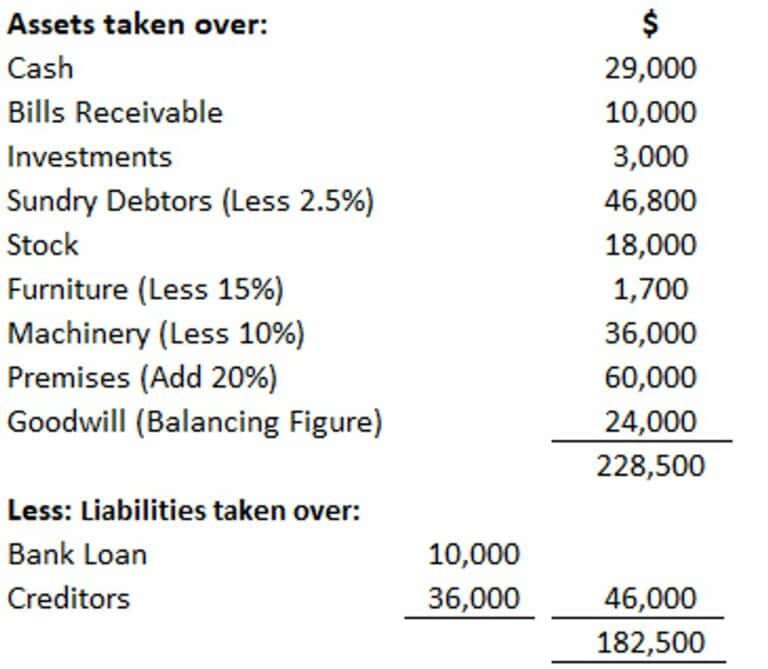

Example Statement of Activities

Questions To Ask Yourself – Statement of Activities

When reviewing a Statement of Activities, ask yourself these questions:

Revenue

- Where is revenue coming from? Is there diversity in the revenue sources of significant weight on a single source?

- Is revenue growing or shrinking over time? (Review the last 3+ years of annual statements of activities)

- Is unrestricted revenue able to cover 3-6 months of average expenses?

Expenses

- Are expenses trending up or down? (Review the last 3+ years of annual statements of activities)

- Does the growth or shrinkage of expenses in particular categories in line with the organization’s goals?

- What percentage of expenses is for program functional expenses versus other categories? 75%-80% of expenses should be program related.

LEARN MORE: Now that you understand the key components of the Statement of Activities, it’s time to learn about the Understanding Nonprofit Cash Flow Statements: A Beginners Guide