Understanding Nonprofit Cash Flow Statements: A Beginners Guide

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

As a nonprofit organization, it is important to have a strong understanding of your organization’s finances. One of the best ways to do this is by looking at your organization’s cash flow statement.But does a statement of cash flows help you track your organization’s financial health and make informed decisions about how to best use your resources?

In this article, we will discuss the importance of nonprofit cash flow statements, key takeaways when reading them, and some tips for using them.

What Is a Cash Flow Statement In a Nonprofit

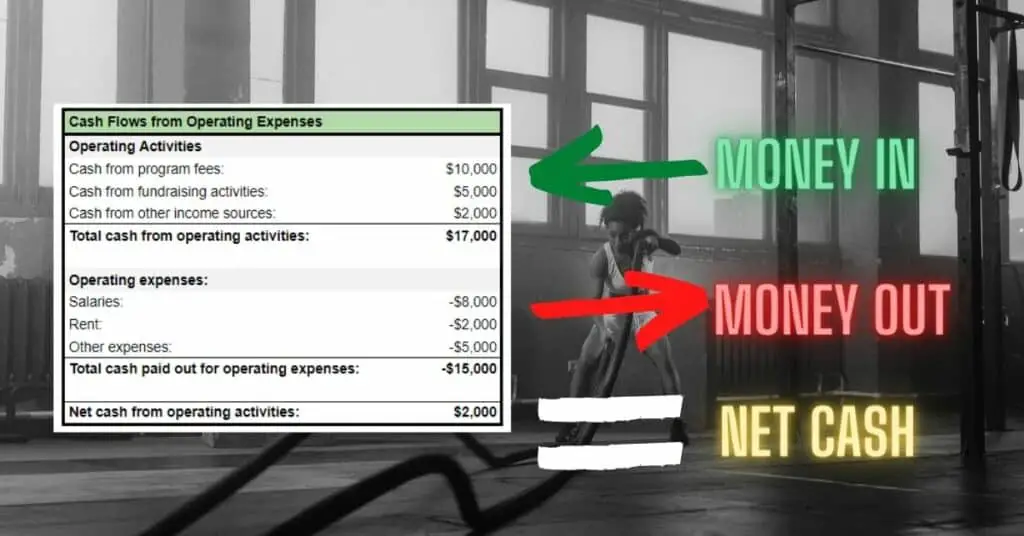

A cash flow statement is a financial document that details the inflows and outflows of cash for a company over a specific period of time. The cash flow statement can be used to give insights into a company’s operating, investing, and financing activities. It can be used to identify over/underspending compared to the inflow of cash into the organization.

When reading a statement of cash flows, you can quickly see how much cash came into the organization vs. how much went out. For example, if a nonprofit shows $10,000 of operating income and $16,000 of operating expenses going out of the organization, this can put the organization in the “red” if the pattern continues.

When looking at a cash flow statement, you can assess the company’s ability to generate cash, how much money is being used to finance day-to-day operations, and how much cash is being reinvested back into the company. The cash flow statement can also be used to assess the company’s liquidity, which is a measure of its ability to pay its short-term debts.

Some organizations will even provide a modified statement of cash flow by month over a 12 or 13 months time period as a way of easily picking up on positive and negative trends or historical ups and downs.

LEARN MORE: Can you read the four critical financial statements of a nonprofit? Read our no BS beginners guide to nonprofit financial management. While eating your lunch, you’ll walk away knowing the basics. Give it a quick read.

Understanding the Nonprofit Statement of Cash Flows

As a nonprofit organization, you will use your statement of cash flows to track the cash coming in and going out of your organization at a high level. This information is important to help you make sound financial decisions, as well as to meet the requirements of grantors and other funding sources.

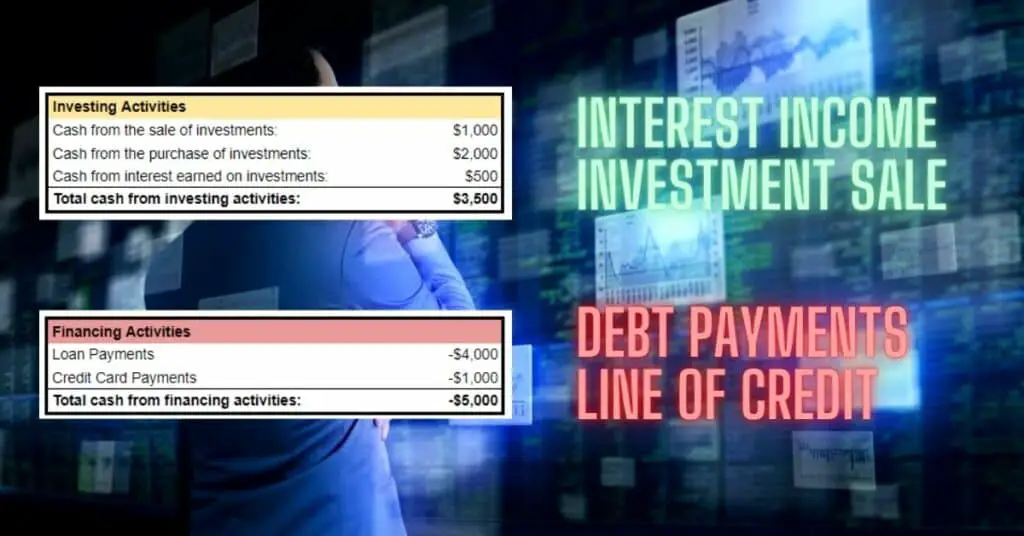

Your statement of cash flows will include three sections: operating, investing, and financing activities. Each of these sections will give you information about different aspects of your cash flow.

Operating activities include all the cash that comes in and goes out from your organization’s day-to-day activities. This can include things like cash from program fees, cash from fundraising activities, and cash from other income sources. It can also include things like cash paid out for salaries, cash paid out for rent or other expenses, and cash paid out for grants.

Investing activities include all the cash that comes in and goes out from your organization’s investments. This can include things like cash from the sale of investments, cash from the purchase of investments, and cash from interest earned on investments.

Financing activities include all the cash that comes in and goes out from your organization’s financing activities. This can include things like cash from the sale of assets, cash from the repayment of loans, and cash from the issuance of new debt.

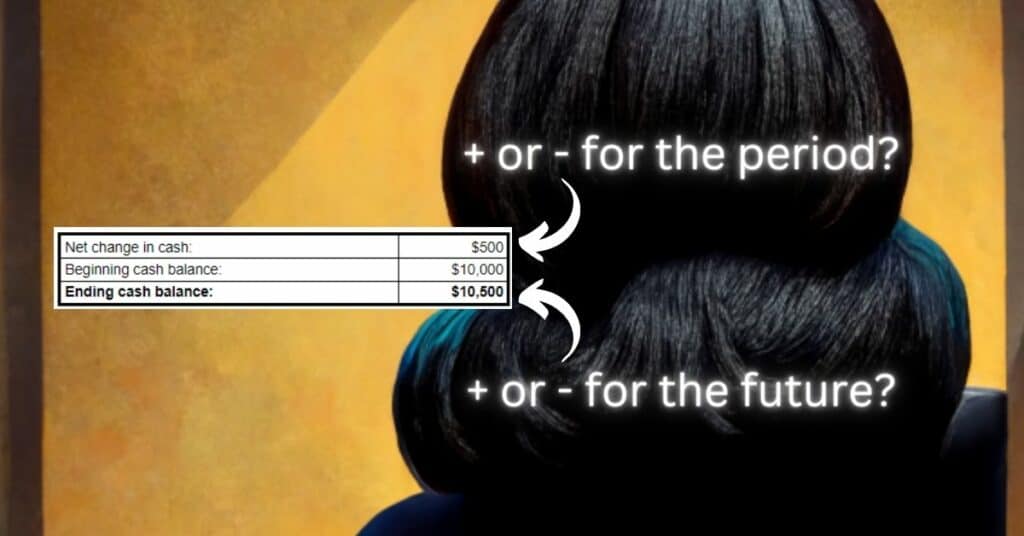

The Net Change in Cash and the Ending Balance lines on a nonprofit’s cash flow statement can give you a good idea of the organization’s overall financial health. A positive net change in cash indicates that the nonprofit has more cash on hand than it did at the beginning of the period. This is typically what you want to see.

A negative net change in cash indicates that the nonprofit has less cash on hand than it did at the beginning of the period.

The ending balance should be a positive number, which indicates that the nonprofit has enough cash to cover its expenses. If the ending balance is negative, it may be a sign that the nonprofit is in financial trouble.

Importance of Nonprofit Cash Flow Statements

Your nonprofit cash flow statement is an important financial document that can give you insights into your organization’s financial health. It can help you track your progress towards your financial goals, and it can help you identify areas where you may need to make changes.

Your cash flow statement can also be used to help you make decisions about your organization’s future. For example, if you are considering expanding your program, you can use your cash flow statement to help you decide if you have the resources to do so.

Your cash flow statement can also be used to help you communicate with your stakeholders about your organization’s financial health. For example, if you are looking for new funding, you can use your cash flow statement to show potential funders how your organization is doing.

What To Look For In a Nonprofit Statement of Cash Flows

There are a few key things to look for when you are reviewing your nonprofit cash flow statement.

- Ensure operating cash flow is positive

- Positive investing cash flow

- Financing cash flow that is positive

First, review and ensure your operating cash flow is positive. This means that you are bringing in more cash than you are spending on operating expenses. If your operating cash flow is negative, it means that you are spending more on operating expenses than you are bringing in. This can be a sign that your organization is in financial trouble.

Second, you want to make sure that your investing cash flow is positive. This means that you are bringing in more cash from your investments than you are paying out. If your investing cash flow is negative, it means that you are paying out more in investment expenses than you are bringing in. This can be a sign that your organization is not making wise investment choices.

Third, you want to make sure that your financing cash flow is positive. This means that you are bringing in more cash from your financing activities than you are paying out. If your financing cash flow is negative, it can be a sign that your organization is not making wise financial decisions. Look at your debt-to-income ratio and make sure you are not over-borrowing.

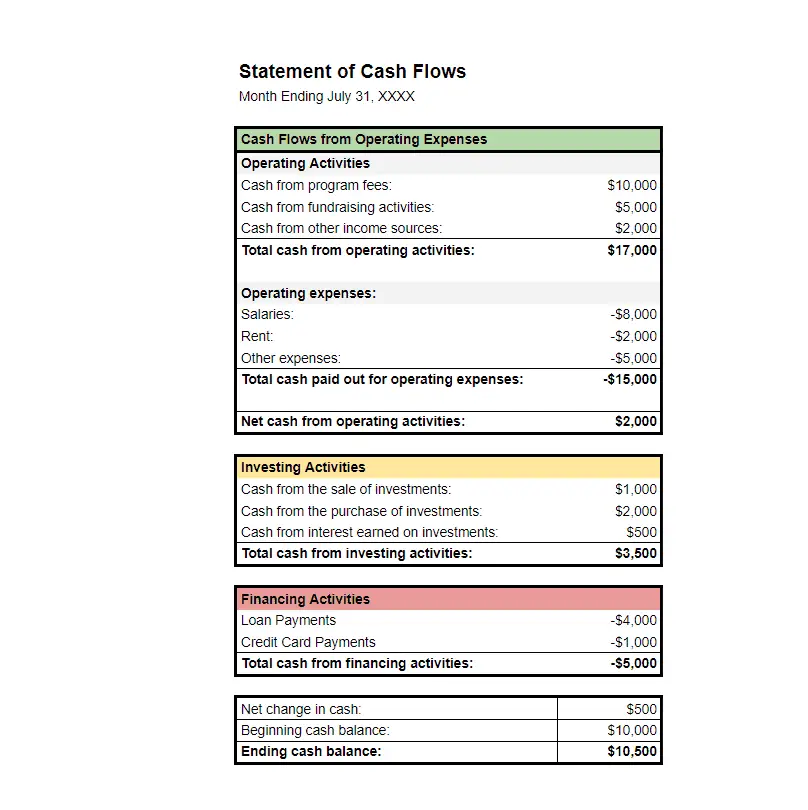

Example Cash Flow Statement for Nonprofit Organizations

The following is an example of a cash flow statement for a nonprofit organization. This example is for illustrative purposes only and is not meant to be used as a template.

In Summary

A nonprofit cash flow statement is one of the most important financial documents for any organization. It provides a clear picture of the organization’s financial health and can help identify areas where improvements can be made.

While the statement may seem daunting at first, it is relatively simple to understand with a little bit of practice. By becoming familiar with the different elements of the statement and how they relate to one another, you will be able to quickly and easily interpret the information contained within.

Look for positive monies in, and ending cash balances.