Basics of Nonprofit Budgeting: A Beginners Guide

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

Nonprofit organizations are often underfunded, which can cause financial stress and strain on the organization. What is budgeting? How can you start? Read on to learn more.What Are the Basic Elements of a Nonprofit Budget

Budgeting is the process of planning, organizing, and controlling financial resources and how they are allocated to achieve organizational goals. It’s important to budget because it helps the organization manage its funds in a more effective way.

The budget should be maintained using cash flow forecasting, forecasting revenue and expense, and analyzing expenditures’ effectiveness. The budget should also include an analysis of all short-term, medium-term, and long-term financial forecasts.

LEARN MORE: Can you read the four critical financial statements of a nonprofit? Read our no BS beginners guide to nonprofit financial management. While eating your lunch, you’ll walk away knowing the basics. Give it a quick read.

How to Create and Track a Nonprofit Budget

There is no one-size-fits-all answer to this question, as the steps involved in creating a nonprofit budget will vary depending on the specific organization and its financial situation.

However, some general steps that may be involved in creating a nonprofit budget include:

- Determine the organization’s financial goals and objectives.

- Review the organization’s past financial performance.

- Identify the organization’s major sources of income and expenses.

- Estimate the amount of income and expenses for the upcoming budget period.

- Create a budget that allocates the organization’s resources in a way that supports its financial goals and objectives.

- Review the budget periodically to ensure that it remains accurate and relevant.

1. Determine the organization’s financial goals and objectives

The first step in creating a nonprofit budget is to determine the organization’s financial goals and objectives. This will help to ensure that the budget is aligned with the organization’s overall strategy and that resources are being allocated in a way that supports the achievement of these goals.

For example, if one of the organization’s goals is to increase its funding from grants, then the budget may need to include funds for research on potential grantors and for writing and submitting grant proposals.

2. Review the organization’s past financial performance

Reviewing the organization’s past financial performance is another important step in creating a nonprofit budget. This information can provide insights into trends in the organization’s income and expenses, which can be helpful in estimating future income and expenses.

It can also help to identify areas where the organization may have been overspending or under-earning, which can then be addressed in the budget.

3. Identify the organization’s major sources of income and expenses

Another step in creating a nonprofit budget is to identify the organization’s major sources of income and expenses. This information can be used to estimate income and expenses for the upcoming budget period.

For example, if the organization’s major sources of income are donations and grants, then the budget may need to include funds for fundraising activities and grant writing.

4. Estimate the amount of income and expenses for the upcoming budget period

Once the organization’s major sources of income and expenses have been identified, the next step is to estimate the amount of income and expenses for the upcoming budget period.

This can be done by reviewing past financial performance and trends, as well as by considering any changes that may be coming up in the organization’s operations.

For example, if the organization is planning to launch a new program, then the budget may need to include funds for start-up costs such as marketing and program development.

5. Create a budget that allocates the organization’s resources in a way that supports its financial goals and objectives

After the organization’s income and expenses have been estimated, the next step is to create a budget that allocates the organization’s resources in a way that supports its financial goals and objectives.

This may involve allocating funds to specific activities or programs that are aligned with the organization’s goals, as well as ensuring that there is enough money allocated to cover the organization’s fixed costs.

6. Review the budget periodically to ensure that it remains accurate and relevant

Finally, it is important to review the budget periodically to ensure that it remains accurate and relevant. This may involve making adjustments based on changes in the organization’s operations or financial situation.

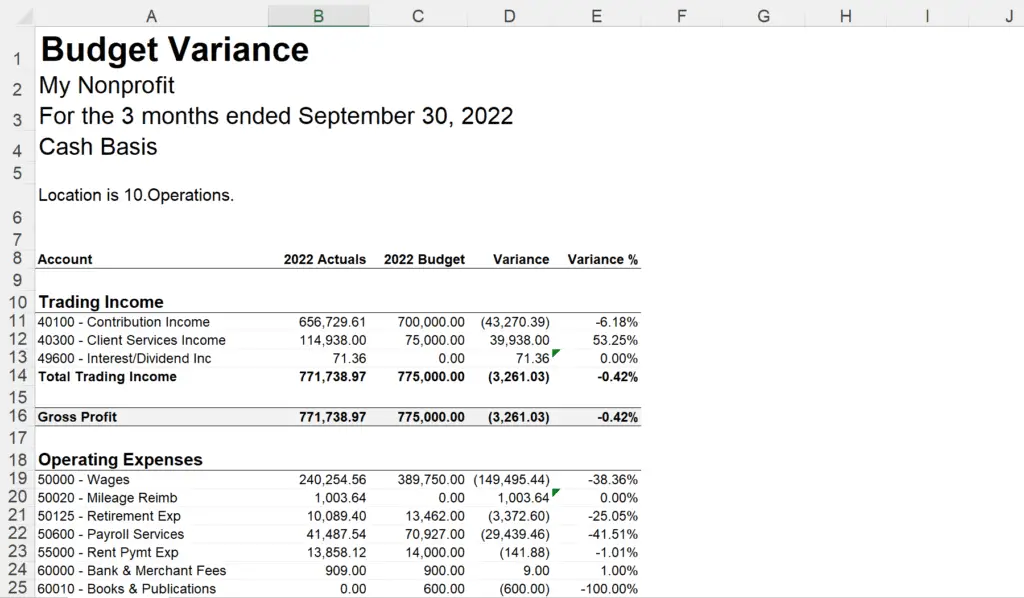

We recommend reviewing your Budget to Actuals on a monthly basis. This is a standard accounting report that shows how much was budgeted year to date compared to how much has actually been spent.

How to Evaluate and Optimize a Nonprofit Budget

Like many businesses, nonprofit organizations often lack the resources and funding to do everything they want. As a result, they need to evaluate their budget and make cuts while continuing to grow. In order to be as effective as possible with your nonprofit budget, you need to be strategic about how you use your money.

Many nonprofits also use a budgeting technique called cost-benefit analysis. This is an easy way for nonprofits to figure out what will work best for them based on the value it provides and whether or not the costs are worth it.

Imagine that you’re planning a fundraiser for your nonprofit. You can use cost-benefit analysis to determine if the event would be more valuable than some other methods of fundraising.

If you’re planning a fundraising event that includes food, remember that it’s going to cost more money than if you were charging people for tickets because the food will have to be provided–but this type of fundraising is beneficial because people will come back even if the event doesn’t raise enough money.

At the end of the day, the fundraising event should bring in some multiple more in fundraising than it cost to put on the event. i.e. There is X benefit for the cost Y

What are the different types of nonprofit budgets (Operating, Cash Flow, and Capital)

Nonprofit organizations can have multiple types of budgets. There are three primary types of these budgets: Operating, Cash Flow, and Capital. All three are important in the long-term growth and sustainability of your organization.

When we discuss budgeting here, we are typically referring to an operating budget, the budget of income and expenses to operate the nonprofit. An operating budget is a budget that is used to cover basic day-to-day costs like materials, supplies, rent, utilities, etc. It’s not designed to cover large expenses such as capital projects, i.e buying a building.

A cash flow budget is focused on covering big expenses like capital projects or payroll work. It’s meant to help you manage your cash flow so that you can run smoothly while achieving the goals you have set out for your organization.

A capital budget is a long-term financial plan that covers major investments and projects needed to strengthen your organization over time to sustain its growth. A capital budget typically includes things like building new facilities or acquiring new equipment needed to meet the demands of increased demand for services provided by the nonprofit organization.

At a minimum, you will be creating and reporting on an operating budget.

Historical vs. Zero Based Budgeting in a Nonprofit

There are two primary ways that a nonprofit organization can choose to budget its finances – historical budgeting and zero-based budgeting.

Historical budgeting simply means using the previous year’s budget as a starting point for the coming year’s budget. This can have some advantages, as it can be easier to get an idea of what has been spent in the past and can help to predict future spending.

However, it can also lead to a lack of transparency and accountability, as well as to a feeling that the budget is not truly reflective of the organization’s needs.

Zero-based budgeting, on the other hand, starts from scratch each year, with all expenses being justified anew. This can be a more time-consuming and difficult process, but it can also lead to a more accurate and transparent budget.

Which budgeting method should I use?

There is no right or wrong answer to this question – it depends on the needs of your organization and what you feel is most important.

If you are looking for a more transparent and accountable budget, you may want to consider using a zero-based budget.

However, if you feel that it is more important to have a budget that is easier to create and that reflects past spending patterns, you may want to use a historical budget.

Which budgeting method is the easiest?

There is no easy answer to this question either – it depends on the size and complexity of your organization and on your own personal preferences.

If you are comfortable working with numbers and have a good understanding of your organization’s finances, you may find that zero-based budgeting is not as difficult as it initially seems.

However, if you find it difficult to keep track of your organization’s finances or if you feel that a historical budget is more reflective of your organization’s needs, you may want to stick with that method.

How to determine nonprofit income for a budget?

The best way to determine nonprofit income for a budget is to review the organization’s financial statements from the previous year. This will give you an idea of how much money the organization brings in from donations, grants, and other sources of revenue.

If you don’t have a fundraising history to work from, you can use a fundraising goal as a starting point. This can be based on the amount of money you need to raise to cover your expenses, or it can be a specific dollar amount that you would like to raise.

Once you have a general idea of how much money you need to bring in, you can start to develop a budget. This should include income and expenses for the upcoming year.

If you are still unsure of how to develop a budget, you can consult with a financial advisor or accountant. They will be able to help you create a budget that meets your needs and ensures that your nonprofit is financially stable.

How to Budget For Expenses

There are a few things to consider when budgeting for expenses in a nonprofit. The first is to make sure that all of the expenses are covered by the income of the organization. The second is to make sure that the expenses are in line with the goals of the organization. The third is to make sure that the expenses are affordable and realistic.

In particular, the following types of expenses and funds should be included in your budget:

- Operating expenses: These are the day-to-day expenses necessary to keep your nonprofit running. They include things like office supplies, salaries, and rent.

- Program expenses: These are the costs associated with running your nonprofit’s programs and services. They can include things like materials, equipment, and staff time.

- Fundraising expenses: These are the costs associated with raising money for your nonprofit. They can include things like marketing, event expenses, and professional fees.

- Administrative expenses: These are the costs associated with running your nonprofit’s administrative functions. They can include things like office expenses, legal fees, and accounting services.

- Reserve Funds: These are funds set aside to cover unexpected expenses or income shortfalls. [Learn more about Operating Reserves and building a financially resilient organization.]

To ensure that all expenses are accounted for, it is helpful to create a budget template that can be used on an annual or monthly basis. This template should include line items for all of the above expense categories, as well as others that may be specific to your organization. Once all expenses have been accounted for, you can then begin to allocate funds to each category.

When determining how to allocate funds, it is important to consider the organization’s overall goals and objectives. For example, if the goal is to increase access to services, then a greater proportion of funds should be allocated to program expenses. Alternatively, if the goal is to increase donor support, then a greater proportion of funds should be allocated to fundraising expenses.

Once the budget has been created, it is important to monitor actual expenses and income on a regular basis. This will allow you to make adjustments as needed to ensure that the organization remains on track to meet its financial goals.

What tools should I use to create a nonprofit budget?

There are a number of tools that can assist in creating a nonprofit budget. Some of the best options include Google Sheets, Excel, and budgeting software programs like Xero or QuickBooks.

Google Sheets is a great tool to use for creating nonprofit budgets due to its ease of use and robust features. Using Google Sheets, you can create financial reports and track expenses and revenue. You can also create graphs that display your financial data over time.

Excel is another popular tool for creating nonprofit budgets due to its ease of use and plethora of useful features. Using Excel, you can create tables that display the organization’s finances over time. You can also create graphs that display your financial data over time.

Finally, budgeting software programs like Xero or QuickBooks are excellent tools for creating nonprofit budgets due to their ease of use and robust features. Using these programs, you can easily set up financial reports that display the organization’s finances over time, track expenses and revenue, and create graphs that display your financial data over time.

If you use accounting software to for your budget, there is the benefit of those budget to actual reports we discussed earlier.

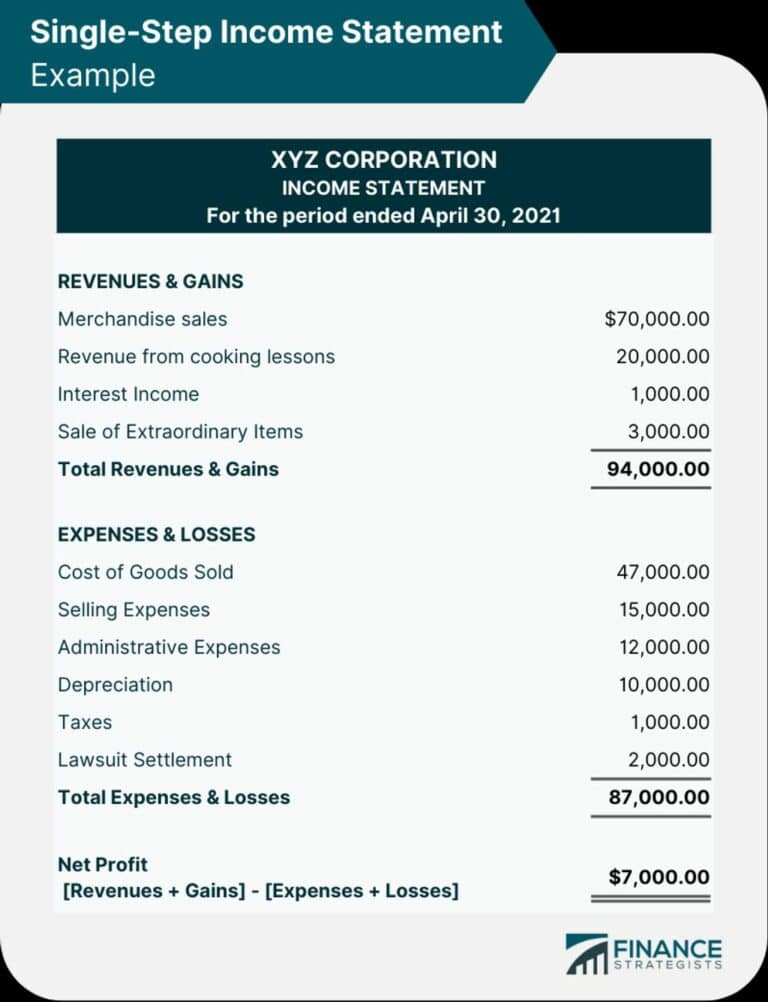

Here’s an example of a Budget Variance report exported from Xero to Excel.

Any tips for creating your first nonprofit budget?

If you have started a new nonprofit, you will still need to create a budget. This can be a daunting task for a new nonprofit because you do not have history to review, but there are some tips that can help make it easier.

- Define your programmatic goals and objectives. This will help you identify the costs associated with achieving your goals. You’ll need to price out some of the bigger and more used supplies as well as the personnel required to execute the program.

- Do your research. Look at other nonprofit budgets and get an idea of what typical costs are for the type of programs you will be running. Seriously, reach out to others, they may be very happy to share information about their budget and their costs. Look for nonprofits offering similar services.

- Build in flexibility. Don’t be afraid to make adjustments to your budget as you get a better understanding of your actual costs, even during the fiscal year.

- Have a plan for fundraising. Make sure you include fundraising goals and activities in your budget so you can offset some of the costs of running your nonprofit. Make sure the plan for fundraising if laid out on a monthly basis. Doing this allows you to review how you are doing every four weeks rather than only a few times per year.

- Keep it simple. Don’t try to make your budget too complicated. Keep it easy to understand so you can make changes as needed.

FAQ / Questions and Answers

Can nonprofits budget a profit? More income than expenses? It is a myth that nonprofits cannot have more income than expenses. This is the definition of a profit. Yes, profit in a charity is perfectly acceptable as long as those profits are used for the nonprofit’s charitable purposes and not for the benefit of the Board or key staff. In fact, healthy nonprofits will do this to help fund 3-6 months of operating reserves.

Where can I find best practices for nonprofit budgets? There are many resources around best practices including the Council of Nonprofits and AAFCPAs.