Nonprofit Revenue Sources: Startup Series

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

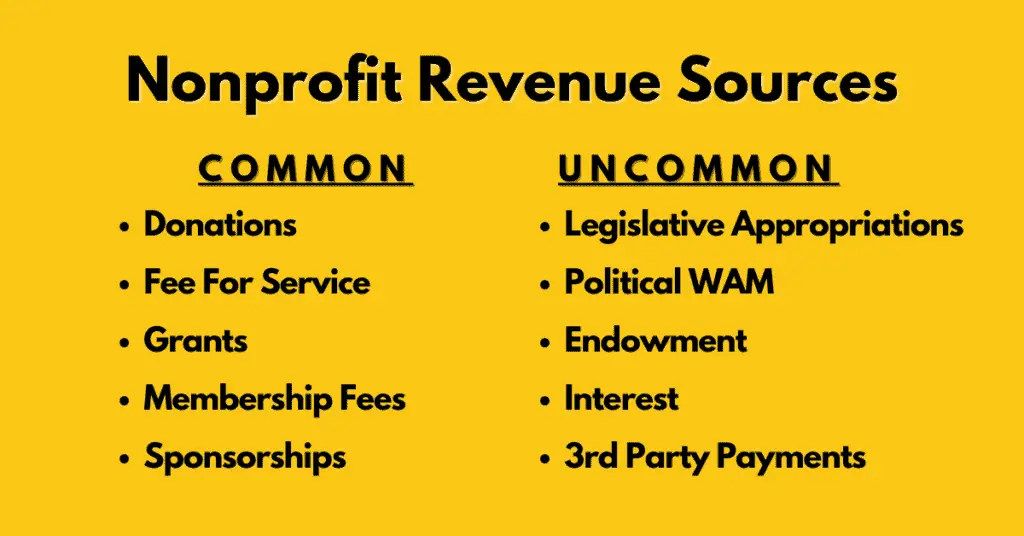

A nonprofit, charity, and other social enterprises may make us feel like using words from the business world is taboo. Do revenue, sales, income, and other terms feel inappropriate in the social sector context?In general, there are five types of revenue in nonprofits. These are contributions (donations), fees for service, grants, membership fees, and sponsorships. Five uncommon nonprofit revenue sources include legislative appropriations, political WAM, endowments, interest, and 3rd party payments.

Revenue is not a dirty word. In fact, it is the lifeblood of a nonprofit. Too little, the nonprofit will eventually die. Too much, and you may endanger your organization.

Let’s look at why revenue is important and then review XX potential revenue sources before sharing our considerations for selecting the sources that match your organization best.

Why Is Revenue Important To A Nonprofit Organization?

Ok, let’s get over a hurdle to the discussion.

Nonprofits cannot operate without revenue! In order to provide services, products, or perform activities, there are some costs (expenses) that need to be covered.

Even the filing fee to start the nonprofit is an expense. Where did those funds come from? If you paid out of pocket to create your 501(c)(3) corporation, those funds are revenue to the nonprofit. Maybe those funds were in the form of a donation or a grant, but it is still revenue.

[READ ON]: We have the numbers. How much does it cost to start a nonprofit organization?

Revenues are how monies come into the nonprofit so that the activities toward the social impact goals can be achieved. Revenue is what allows vehicles to be purchased, services to be offered for free or at a discounted rate, employees to be paid, animals to be fed, meals to be prepared and distributed, and more.

But, what about donations? Isn’t that how we are able to do those things in a nonprofit. Yes! That is one potential revenue source. But it is not the only one.

So, revenue is something all nonprofits work with, regardless of what you call it. It’s not a dirty word. Revenue can provide the freedom to increase your social impact in a substantial way.

Revenue can come from a variety of sources, just like in the for-profit world. But the purpose and some of the rules are unique to nonprofit, charity organizations.

Let’s look at 5 common sources of revenue first, and then dig into a number of less common, but possible nonprofit revenue sources.

Revenue 101 – Sources Of Revenue For Nonprofits

While creating your business plan (our article), it is important that you understand the five primary sources of revenue for nonprofits. But even these are not the only sources available to you.

These are high-level categories of revenue. Within each one there are many different ways and means to generate that type of revenue.

Let’s jump in with the most common nonprofit revenue sources.

Contributions (Donations)

Contribution income is often referred to as donations. These are contributions to your nonprofit from individuals or organizations (businesses).

In a Bloomerang survey, 53.37% of respondents indicated the major donor gifts were vitally important to the nonprofit.

Whether the donations are obtained through an online giving form, a special event, or planned giving, all of these donations are Contribution income.

Keep in mind that donations are not an exchange of an item or service of worth back to the donor. A donation is a charitable gift without the donor receiving something of value in return.

A fee for a service is not a donation because the person is receiving a service of value in exchange. Buying a T-Shirt from a nonprofit is a transaction, not a donation because the buyer received that T-Shirt in exchange.

From day one you will need to track who gave, when they gave, how much, and any restrictions. Good accounting practices will go a long way if you start with them now.

Restricted vs. Unrestricted Donations

Donations come in two forms, restricted or unrestricted.

Unrestricted donations (contributions) are just that. They can be used for any charitable mission purposes within the nonprofit.

If you suddenly need to replace a van because the engine gave out, unrestricted gifts can be used to buy that van. Those same funds could also be used to pay for a new employee’s salary and benefits or to purchase supplies for a specific program.

The point is that unrestricted gifts can be used to cover your organizational expenses without being locked into a specific purpose.

On the other hand, restricted gifts can only be used in a manner consistent with the restriction placed on the donation by the donor.

For instance, a donor may give a donation toward a project to build a new animal shelter. In this case, the donation is restricted and can only be used toward that project. It cannot be used to buy a new van.

You are accountable to ensure those donor restrictions are honored. This requires proper tracking in your accounting system. Failing to do so can land you in hot water legally and break trust with your donors.

Can A Donor Restriction Be Changed On A Donation Already Made?

In general, the good news is that a donor restriction can be changed if the donor agrees to it in writing. For donations made to a nonprofit with a restriction on them, it is possible to explain the reason for a requested change with the donor and obtain a written communication from the donor giving permission to remove the restriction or change the restriction.

However, you want to do this only as a last resort. If you raised funds for a specific project, it is important to fulfill the commitment.

Yet, we know that circumstances can sometimes change and a project is not going to go forward. In that case, it is important to have a discussion with the affected donors.

There are really three potential options when a restriction on a donation cannot be fulfilled: hold the funds for future potential to fulfill, return the funds to the donor, or ask for a change or removal of the restriction.

Fee For Service

Many nonprofits provide services that some or all clients pay a fee for. For example, a nonprofit health clinic may offer medical exams on a sliding fee scale.

The monies paid in exchange for the transactional service are classified as this Fee For Service income.

Because there is an exchange of value taking place, these fees for service are not charitable gifts and therefore not donations.

However, many nonprofits allow their clients to give an additional gift (donation) above and beyond the fee they are charged. Think of a Pay-It-Forward campaign.

You do need to be careful of what the fee is for the service and separately they are also making a donation. Talk to your accountant first.

Grants

Grants are awarded monies, products or services to a nonprofit without any repayment terms. These are not loans.

Grants are technically contribution income but they are special. When reporting income, grants will be described as a separate source even on your Form 990.

These may be government grants or public/private foundation grants. Government grants may have heavier reporting and tracking requirements than private foundations. But be prepared to track and report well in either case

You apply for grants and if awarded, are bound to the grant terms which typically restrict the use of their funds for specific purposes and have reporting guidelines attached.

There are an incredible number of purposes behind grants. Some grants help provide matching funds for a new facility, others help build organizational capacity to grow impact quickly.

Membership Fees

Another type of revenue is membership fees. Some nonprofits charge a fee on a monthly, quarterly, or annual basis that provides members with access to certain services or benefits.

For instance, an after-school program might use a membership model that provides a snack, homework help, and access to sports equipment for a fixed fee membership.

Another example is a museum that has a membership program where members pay a fee. Depending on their membership level, they receive increasing levels of access to private tours, special event access, or product discounts.

It is important to note that the membership fees are not considered a charitable gift and therefore are likely not able to be tax-deductible by the member. The member is receiving a benefit in exchange for the membership fee. That’s not a donation.

Sponsorships

Sponsorships are similar to a membership above, but for a corporate or business entity.

A very common example is a charity golf tournament. Businesses will “sponsor” a team and/or a hole for a fixed fee for the event.

In return, the business gets the privilege of having four people play golf, a chance to win prizes, and advertising in the form of signage at a hole, printed flyers, website sponsor appearances, and such.

In this case, the business entity has decided to “sponsor” the event to the benefit of the charity.

Unusual Nonprofit Revenue Sources

While we have already covered the most common types of revenue, depending on the type of nonprofit that you are, there are some other sources as well.

Let’s take a high-level look at these less common nonprofit revenue sources.

Legislative Appropriations

Revenue in the form of legislative appropriations is something that is not simple or quick.

These dollars typically come from your organization having an ongoing discussion with legislators about a particular need, or opportunity to impact a social need.

That legislator may eventually come to believe so strongly in the opportunity that they will work to include wording in a bill that provides funding to your organization for specific purposes.

If the bill passes, then you may eventually see this revenue arrive.

Yes, it is unusual in most nonprofits but it does exist.

Let me be candid, I don’t have experience with legislative appropriation. In fact, I have run away from government funding but that is because most of my nonprofit work has a religious/ministry context behind it.

For other nonprofits, this has and can be a help.

Political WAM (Walking Around Money)

I know, another political source of revenue? Yup.

Did you know that in the world of politics, lobbying, and legislation, some groups have dollars that are provided to their “people” as what is commonly referred to as “Walking Around Money” or “WAM”?

These funds, altruistically, are to be handed out when someone with the funds sees an opportunity to benefit the state or country. Literally, they simply see a need and try to help a need in a quick process of funding.

Now, these funds are likely “hat-tip” amounts and are not typically hundreds of thousands of dollars, since they are also trying to spread these dollars across a large base of constituents.

Endowment

In a nutshell, an endowment is a fund created for the explicit purpose of generating income that benefits a charity, college, or other institution. The funds to start the endowment are usually bestowed to the organization as a gift in support of specific purposes, but can also be started from savings or operating reserves. Income is typically generated off of the interest earned on the endowment fund investments.

So, if you have an endowment, the idea is that the principal of the endowment remains and is not used by the charity. The interest earned on the principal dollars can then be invested back into the endowment or provide additional income for the benefiting organization.

There are typically three types of endowments

- Organization Held – The nonprofit Board establishes the endowment in the nonprofit’s name with an explicit fund policy that describes how, what, and when dollars can be used.

- Third-party Held – A third party, like a foundation creates the endowment and determines which organizations it benefits for what purposes.

- Quasi-Endowment – This is not technically an endowment but can operate similarly to one. This is where your nonprofit can take certain savings or reserves and place them in a high-interest account using the interest as additional income for the organization.

Interest

Similar to a quasi-endowment, nonprofits will earn interest on monies in certain financial accounts.

Depending on the type of account and the balance of those accounts, the interest income may be pennies or thousands of dollars.

Either way, interest is a common source of revenue. We list it as uncommon because most nonprofits do not receive any substantial revenue from this source.

Third-Party Payments

Third-party payments are an unusual nonprofit source.

These are payments received from another entity that is not a donation, on behalf of a client or constituent.

One example is in the healthcare space. Third-party payments may be received from insurance companies once a claim is submitted and processed.

The client did not make the payment, nor did a donor. Instead, the insurance company is making a payment based on the benefits identified for the policyholder.

Again, not common across all nonprofits but quite common in the healthcare space. Think of a nonprofit hospital or medical center.

| Nonprofit Revenue Sources | Common | Uncommon |

|---|---|---|

| Donations | X | |

| Fee For Service | X | |

| Grants | X | |

| Membership Fees | X | |

| Sponsorships | X | |

| Endowment | X | X |

| Interest | X | X |

| 3rd Party Payments | X | |

| Political WAM | X | |

| Legislative Appropriations | X |

UBIT (Unrelated Business Income Tax) – What Is UBIT And Is It Bad?

UBIT operations are activities that are not directly related to your core charitable purposes. Any revenue generated from activities not related to your charitable purposes will not be exempt from paying taxes. Thus, UBIT.

First, talk to your accountant for more details, but let’s look at a couple of examples.

You’ve certainly seen the gift shop at a museum. Most of the items in the gift shop will be taxable income to the museum when they are sold. Selling a sticker book, a miniature statue, and a science toy, are not likely part of the charitable mission of the museum.

Essentially, the museum is operating a for-profit business in the gift shop, despite being a 501(c)(3) nonprofit. Since those gift shop sales are not directly related to the charitable purposes of the museum, sales taxes (depending on your state) and profits will be taxable under UBIT.

Again, it gets a little complex so talk to your tax or accounting professional before you start selling things.

That’s not to say that you shouldn’t sell products. In fact, it may be beneficial to your nonprofit even after taxes, just don’t let it take over. But is it right for your organization?

How To Select Your Nonprofit Revenue Sources?

With so many revenue sources available to nonprofits, how do you choose the best one for you?

When determining nonprofit revenue sources, consider five components; missional alignment, expertise, competition, strategic goals, and the right fit.

Missional Alignment

- Is this funding source in alignment with your charitable purposes?

- Does it match our organization’s viewpoints?

- Will it cannibalize other revenue source efforts?

Expertise

- Do I know how to do this?

- Does the organization know how to do this?

- Is the expertise needed contrary to who we are?

Competition

- Who else is doing this in our market?

- How can we do it better to meet our audience?

- Do this foster competition rather than collaboration with similar organizations?

Strategic Goals

- Does it align with any of our strategic goals?

- Will this source increase or decrease based on long-term strategy?

- What’s the true potential ROI on this revenue source idea?

Right-ness

- Does this source feel like “us”?

- Am I comfortable representing our organization for this source?

- Does it make us better?

[READ ON]: Income is just one of 5 key financial numbers every leader should know. Find out what the other four are in our article 5 Financial numbers every nonprofit leader should know

Parting Thoughts

Now that you have seen that nonprofits can generate revenue from many different sources beyond donations, I hope you see the potential to gain the funding needed to rapidly increase your social impact footprint.

Nonprofits need to operate as a business, but a business doing good for good’s sake.

When reviewing potential revenue sources, defer to doing what is right and doesn’t compromise on who you and your organization are.

How To Start A Nonprofit Next Steps

Resources

- https://bloomerang.co/blog/major-gift-fundraising-by-the-numbers/

- https://www.anafp.org/Fund-Accounting

- https://www.propelnonprofits.org/resources/glossary/

- https://www.ecfa.org/PDF/ECFA_Seven_Standards_of_Responsible_Stewardship.pdf