Starting a Nonprofit Organization With No Money

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

There are many ways to start a nonprofit with zero dollars, and each has its own pros and cons. The most important factor in deciding which option best suits your goals and abilities.Some options include forming a board of directors, looking into startup grants, or partnering with another organization. However, before starting a nonprofit, be sure to do your research and weigh the benefits and risks of each option carefully.

Let’s look at this in more detail

Can You Start a Nonprofit Organization with No Money?

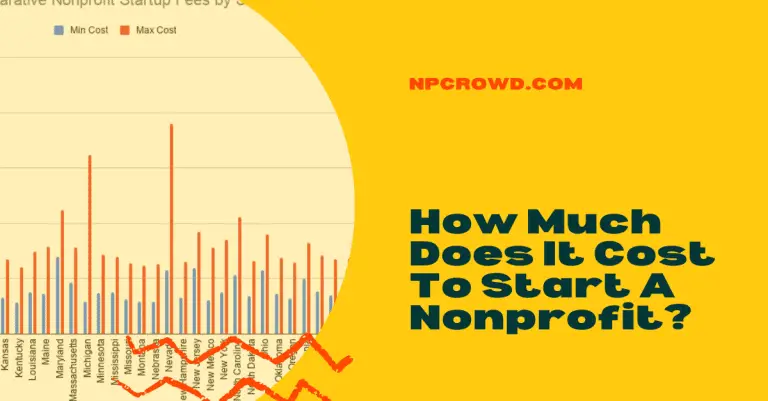

Taking a nonprofit idea and launching a charitable organization can be done with no money of your own, however, all tax-exempt nonprofits including 501(c)(3) type organizations will require between $283 and $2448 in simple fees to complete the legal paperwork, forming a nonprofit corporation, business and charity registrations, and the like.

It is possible and even commonplace for nonprofits to be started with no money out of your pocket, although there are costs that need to be paid for including incorporation, registrations, form 1023, and other associated fees. The money for these expenses can be obtained through several means including startup contributions from future donors, fiscal sponsorship, startup grants, or nonprofit incubators.

Raising the money you need to start your charity has many potential avenues. What becomes even more important is funding for your programs which are the “doing good” part of a nonprofit. It is the social impact that needs to be made. Depending on the type of nonprofit you are creating and the types of programs you will deliver, the operational costs can range from less than $2,000 per year to many tens of millions.

Let’s look at a few options for raising this startup capital.

The Obvious Nonprofit Startup Option, Donations, And Fundraising

There are many reasons to start a nonprofit, but one of the most obvious is donations. Donations can provide a steady stream of income for your organization, and they can also help you build a base of supporters who care about your cause. In order to attract donations, you need to create a compelling case for why people should support your organization. You also need to make it easy for donors to donate money or time. And finally, you need to thank donors for their support.

While it’s possible to begin a funding campaign before you become a nonprofit organization, it might be sensible to wait until you receive your 501(c)(3) letter from the United States Internal Revenue Service before you begin fundraising. If the IRS denies your tax-exempt nonprofit status, you are not eligible to fundraise donations. You could be on the hook for the mess it creates.

That doesn’t mean that well-meaning individuals, potential donors, cannot cover the cost of the initial incorporation, registrations, and IRS filings of your nonprofit. Heck, board members might help makes this happen. Just don’t let them be tax-deductible donations until all is said and done.

Find a Fiscal Sponsorship As A Way To Start A Nonprofit With No Money

Starting your nonprofit is no small feat. Not only do you need to have a clear mission and purpose for your organization, but you also need to have the time and resources to get it up and running. Unfortunately, many people don’t have the money to start a nonprofit from scratch. This is where fiscal sponsorship comes in.

A fiscal sponsor is an organization that agrees to provide administrative and financial support to another group, usually, one that is in its early stages or doesn’t have 501(c)(3) status. This can be a great way to get your nonprofit off the ground without having to worry about fundraising or administrative tasks.

If this option is interesting to you, learn more in our article all about fiscal sponsorships.

What risks does a fiscal sponsorship carry with it for starting a new nonprofit organization? There are a few risks that come with fiscal sponsorship. One is that the sponsoring organization may have a say in how the new organization is run.

Another risk is that the new organization may not be able to raise as much money on its own if it is under the umbrella of a larger organization. Finally, there is always the risk that the relationship between the two organizations will end, which could leave the new organization in a difficult financial situation.

Nonprofit Startup Or Community Grants – Start A Nonprofit

Grants are a great way to help fund your nonprofit startup. They can provide the financial support you need to get your organization off the ground. However, it can be challenging to identify and apply for grants that are a good fit for your nonprofit. Here are some tips to help you get started.

First, do your research. There are many different types of grants available, so make sure you are applying for the ones that are most relevant to your organization. There are also many grant-making organizations out there, so make sure you are targeting the ones that will be most likely to award funding to your nonprofit.

Once you have identified some potential grant opportunities, start putting together a strong application. Be sure to concisely explain what your organization is and what it plans to do.

The biggest risk to this option is that nonprofit startup grants are rare and difficult to obtain so you might consider other options while working on this one. If you are in a hurry to start, seeking grants for the startup capital may not be the best choice.

Nonprofit Incubator – Specialized Startup Option For A New Nonprofit

In the current economy, starting a nonprofit organization can be a daunting task. There are many things to consider when launching a nonprofit, such as fundraising, programs, and staffing. However, there is another option for starting a nonprofit that can help simplify the process: incubators.

Incubators provide support services to help new nonprofits get off the ground and running. This specialized startup option can be a great way to get started if you are not sure how to begin or do not have the time or resources to do everything on your own.

There are many different types of incubators, but most offer some combination of the following services: business planning assistance, mentorship, networking opportunities, training workshops, and financial resources. The best way to find an incubator that is right for you is to do your research.

- NOPI – Nonprofit Incubator

- The Adell Foundation

- Mockingbird Incubator

- Greater Round Rock Community Foundation – Incubator Program

- Mission Accomplish

Do Nonprofit Incubators carry any risks? Nonprofit incubators carry the same risks as any other type of incubator. These include the risk of failure, the risk of not attracting enough talent, and the risk of not providing enough resources.

How Long Does it Take to Start Nonprofits?

Starting a charity can be a daunting task. It takes a lot of time, effort, and resources to get a new nonprofit off the ground. However, with careful planning and execution, it is possible to start a nonprofit in a relatively short amount of time.

A nonprofit can be started in as little as 90 days although this is a very idealistic timeline. More typically, initiating and receiving full tax-exempt status will take 126-144 days.

Can a nonprofit start too quickly? Yes, a nonprofit can start too quickly. If a nonprofit starts without a clear plan or purpose, it may not be able to sustain itself in the long run. Additionally, if a nonprofit does not have the necessary resources in place to support its operations, it may find itself in financial trouble down the road.

Learn more in our popular article about starting a nonprofit, fast.

How Much Money Do You Need To Start a Nonprofit Organization?

While there is no set amount of money required to start a nonprofit, there are some basic startup costs that should be considered.

The first step to starting a nonprofit organization is registering the organization with your state’s secretary of state office. There is usually a fee associated with this process, and the cost varies from state to state. In addition, most states require that nonprofits file an annual report and pay a filing fee.

Other typical costs associated with starting a nonprofit include setting up an accounting system, purchasing insurance, and hiring an attorney. Don’t forget your accountant and tax professional to keep your books and file your organizational Form 990 each year.

How much money you’ll need to cover these costs depends on the size of your organization and where you are located.

Parting Thoughts

Starting a nonprofit organization can be done with little or no money, but there are a few things you need to do in order to make it successful.

First, you need to come up with a good idea for a nonprofit and make sure it is something that you are passionate about.

Next, you need to do some research and create a business plan that outlines your goals and how you plan to achieve them. Finally, you need to find funding and support from the community.

That startup funding will be based on the organization’s needs and may be achieved from multiple sources including fundraising, incubators, fiscal sponsorship, grants, or business sponsorships.

There are many ways to raise money, so don’t give up if you don’t have the money upfront. With hard work and dedication, you can make your nonprofit successful.