How Much Does It Cost To Start A Nonprofit Organization? (Top States)

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

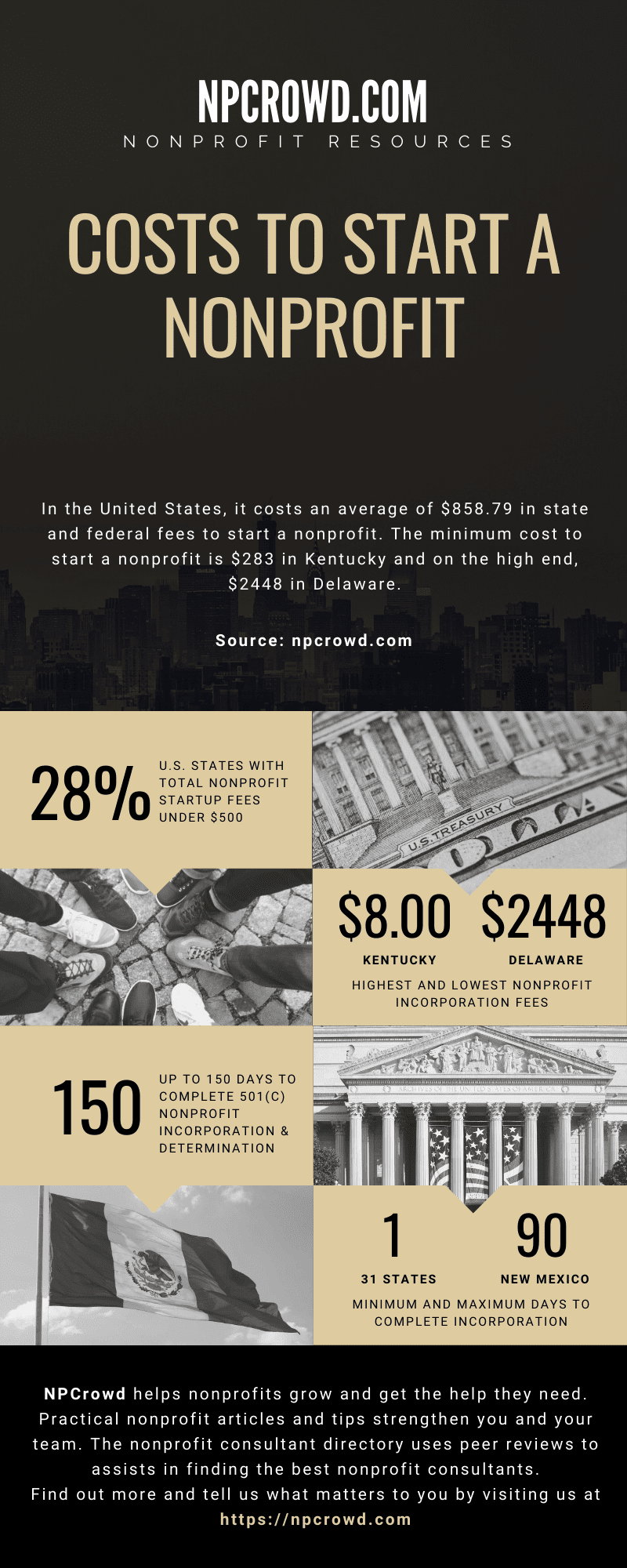

In the United States, it costs an average of $858.79 in state and federal fees to start a nonprofit. The minimum cost to start a nonprofit is $283 in Kentucky and on the high end, $2448 in the District of Columbia. There are other optional costs to consider specific to your nonprofit and up to you to decide.LEARN MORE: Don’t miss out on learning more about starting a nonprofit. Our Starting a Nonprofit In 9 Steps and 91 Days article lists all the steps and provides links to detailed articles along the way.

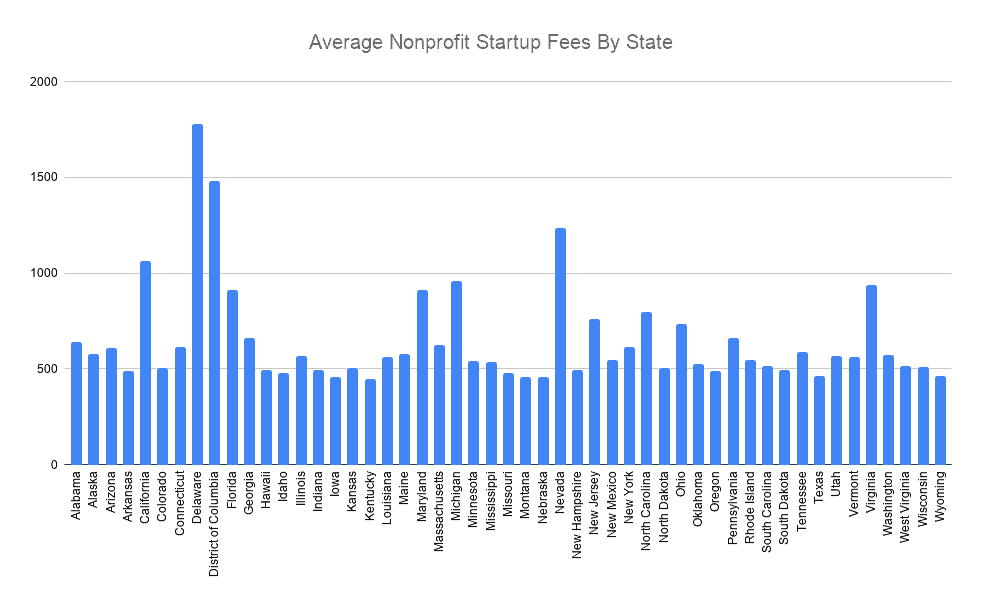

How much does it cost to start a nonprofit near me? [Table]

We researched and found the cost to start a nonprofit in all 50 states. These costs are the approximate total cost of both state fees and IRS 501(c) application.

Note: Some fees are variable in their state. Where possible, we took the minimum and maximum costs for these fees. In other cases, estimates were made.

| State | Avg. Cost | Min. Cost | Max. Cost |

|---|---|---|---|

| Alabama | $640.50 | $478.00 | $803.00 |

| Alaska | $577.50 | $415.00 | $740.00 |

| Arizona | $607.00 | $527.00 | $687.00 |

| Arkansas | $487.50 | $325.00 | $650.00 |

| California | $1,065.00 | $395.00 | $1,735.00 |

| Colorado | $505.50 | $343.00 | $668.00 |

| Connecticut | $612.50 | $425.00 | $800.00 |

| Delaware | $1,781.00 | $1,114.00 | $2,448.00 |

| District of Columbia | $1,480.00 | $1,267.50 | $1,692.50 |

| Florida | $912.50 | $750.00 | $1,075.00 |

| Georgia | $662.50 | $500.00 | $825.00 |

| Hawaii | $496.00 | $321.00 | $671.00 |

| Idaho | $477.50 | $305.00 | $650.00 |

| Illinois | $566.50 | $340.00 | $793.00 |

| Indiana | $492.50 | $330.00 | $655.00 |

| Iowa | $457.50 | $295.00 | $620.00 |

| Kansas | $502.50 | $330.00 | $675.00 |

| Kentucky | $445.50 | $283.00 | $608.00 |

| Louisiana | $562.50 | $375.00 | $750.00 |

| Maine | $577.50 | $365.00 | $790.00 |

| Maryland | $910.00 | $695.00 | $1,125.00 |

| Massachusetts | $622.50 | $460.00 | $785.00 |

| Michigan | $957.50 | $295.00 | $1,620.00 |

| Minnesota | $542.50 | $370.00 | $715.00 |

| Mississippi | $537.50 | $375.00 | $700.00 |

| Missouri | $477.50 | $315.00 | $640.00 |

| Montana | $457.50 | $295.00 | $620.00 |

| Nebraska | $460.00 | $290.00 | $630.00 |

| Nevada | $1,237.50 | $575.00 | $1,900.00 |

| New Hampshire | $492.50 | $330.00 | $655.00 |

| New Jersey | $762.50 | $600.00 | $925.00 |

| New Mexico | $547.50 | $310.00 | $785.00 |

| New York | $612.50 | $375.00 | $850.00 |

| North Carolina | $797.50 | $535.00 | $1,060.00 |

| North Dakota | $502.50 | $340.00 | $665.00 |

| Ohio | $736.50 | $574.00 | $899.00 |

| Oklahoma | $527.50 | $365.00 | $690.00 |

| Oregon | $487.50 | $325.00 | $650.00 |

| Pennsylvania | $662.50 | $500.00 | $825.00 |

| Rhode Island | $547.50 | $385.00 | $710.00 |

| South Carolina | $512.50 | $350.00 | $675.00 |

| South Dakota | $492.50 | $305.00 | $680.00 |

| Tennessee | $587.50 | $425.00 | $750.00 |

| Texas | $462.50 | $300.00 | $625.00 |

| Utah | $567.50 | $405.00 | $730.00 |

| Vermont | $562.50 | $400.00 | $725.00 |

| Virginia | $937.50 | $775.00 | $1,100.00 |

| Washington | $571.50 | $384.00 | $759.00 |

| West Virginia | $512.50 | $350.00 | $675.00 |

| Wisconsin | $507.50 | $345.00 | $670.00 |

| Wyoming | $462.50 | $300.00 | $625.00 |

Video – Answers

What are the fee costs to start a nonprofit?

When we discuss the cost of starting a nonprofit organization, we are referring to the required fees. To be officially recognized as a nonprofit, these fees cover state and federal fees required.

State fees typically include:

- Articles of Incorporation – Filing within a state as a corporation much like a for-profit business does. The incorporation process fees range from $8 to $1098 depending on the state and expedited need of completing the incorporation.

- Charitable Registration – Registering as a charity is required in some states and may be an additional fee. The average name registration fee is $85.91, ranging from $0 to $425.

- Business Registration – Obtaining a business license or registering as a business in your state may be required. Depending on the type of nonprofit you are, this fee may be waived in some states, while others do not require any additional business registration. The average business registration fee is $170.38. The highest costs were $412.50 in the District of Columbia.

- Miscellaneous State Fees – These are state-dependent fees required in particular situations. These fees include sales tax permits, sales tax exemptions, annual registration, gambling license, name registration, and others. The average miscellaneous fees are $194.63.

- IRS 501(c) Filing – To be recognized as a 501(c) nonprofit, you will need to file the appropriate forms with the IRS and wait on a determination letter. Form 1023 is $600, and Form 1023-EZ is $275.

How much does a lawyer cost to start a nonprofit?

If you need assistance with creating the articles of incorporation or other required documents, you may need legal help.

For legal help, there are three options:

1. Use An Online Service

Opinions vary wildly about these services. The type and complexity of your nonprofit may determine your results. Reputable services like Harbor Compliance will cost you $1,699 to $2,599 and will do it right. We recommend staying away from the $149 packages that are anything but a deal.

2. Hire A Lawyer

It is undoubtedly apparent that using a reputable, experienced lawyer in nonprofit formation is most likely to succeed. At the same time, this may be a pricier option.

The typical rate for a lawyer runs from $150 to $500 per hour. When you consider that a nonprofit formation project may take 16+ hours, you may be looking at $2,400 to $8,000.

Some lawyers have fixed fee packages for starting a nonprofit. Others may offer a discounted rate for a nonprofit organization.

One way to save some significant dollars is to self-prepare all the documents yourself and then have a lawyer review them before submission.

3. Pro Bono Assistance

Do you have a lawyer in your town or a personal network that you know? You can always inquire about their services and see if they offer to do the work pro bono. Call other nonprofits and see if they have any recommendations. Just remember, a lawyer’s time is just as important and costly as your own.

Infographic – Cost to start a nonprofit

What other costs do I need to start a nonprofit?

Starting a nonprofit, like any startup business, has costs beyond state and federal filing fees.

Other costs to consider include:

- Insurance – liability, directors & officers, sexual abuse & molestation, casualty, property, and more. Find a provider.

- Office Space – Rent/lease of office space, desks, chairs, phones, cleaning supplies, appliances, etc… if your nonprofit needs this.

- Communication Services – Will you need telephone and internet services? Don’t use your personal cell phone as the official nonprofit telephone number.

- Office Supplies – Pen, paper, toner/ink, printer, envelopes, postage.

- Branding – Logo, signage, marketing materials

- Banking Services – separate bank accounts for the nonprofit. Don’t intermingle your personal finances.

- CPA/Accountant – You will likely need some advice, if not assistance, from an accountant versed in nonprofit finances and tax requirements. Find nonprofit accounting help.

Be sure to avoid these 13 nonprofit startup myths.

What is the best state to incorporate a nonprofit? [Top 10]

The states with the lowest nonprofit incorporation fees are:

- Kentucky – $8.00

- Nebraska – $15.00

- Iowa – $20.00

- Kansas – $20.00

- Michigan – $20.00

- Montana – $20.00

- Texas – $25.00

- Wyoming – $25.00

- New Mexico – $25.00

- Oklahoma – $25.00

Perhaps you are looking for the lowest fee costs to start a nonprofit. If this case, these are the states with the lowest total costs to start a nonprofit:

- Kentucky – $283

- Nebraska – $290

- Iowa – $295

- Michigan – $295

- Montana – $295

- Texas – $300

- Wyoming – $300

- Idaho – $305

- South Dakota – $305

- New Mexico – $310

The most expensive states to start a nonprofit, including speedy expedited incorporation fees, are:

- Delaware – $2,448

- Nevada – $1,900

- California – $1,735

- District of Columbia – $1,692.50

- Michigan – $1,620

- Maryland – $1,125

- Virgina – $1,100

- Florida – $1,075

- North Carolina – $1,060

- New Jersey – $925

Conclusion

Starting a nonprofit costs up to $2448 in state and federal fees. If you need legal assistance, the total cost grows to up to $10,248 but as low as $283 with pro bono legal help.

![3 Meta Nonprofit Organizational Structures: A Comparison 6 3 Meta Nonprofit Organizational Structures [Comparison]](https://npcrowd.com/wp-content/uploads/2021/11/3-Meta-Nonprofit-Organizational-Structures-Comparison-768x402.png)