Expensify Alternatives To Use in 2023: Alternatives & Comparisons

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

On average, Expensify alternatives range in cost from $0 to $54 per user per month compared to Expensify’s $4.99/user per month starting plan. The average monthly fee per user for Expensify alternatives ranges from $7.41 for entry-level plans, while higher-level plans averaged $28.00. These Expensify alternatives include Divvy, our recommendation for nonprofits, Fyle and Concur (SAP).Maybe you already use Expensify. Perhaps you know about Expensify but want to take a good look at alternatives before making a decision.

Whatever your reason, we’ve compiled a list of expense management alternatives that you may want to check out.

[Updated for 2023]

When evaluating expense management apps like Expensify, it is crucial to understand what pain points you are trying to solve and which features you need.

Levvel Research has an updated report with key insights from survey respondents about travel and expense management. According to Levvel, the top three challenges are:

- Manual entry and routing of expense reports (41%)

- Lengthy approval and reimbursement cycles (32%)

- Lack of visibility into spend/travel data (31%)

When selecting a new expense management tool, you will need to identify the feature needed to address the pain points you’ve identified for your organization. According to Levvel Research, the most important expense management features are as follows:

- Expense report approval (51%)

- Expense report creation and submission (46%)

- Travel booking (43%) [Not necessary if only looking for expense management]

- Reporting and Analytics (43%)

- Expense capture/receipt imaging (40%)

- Reconciliation and reimbursement (35%)

- Mobile application (35%)

- Credit Card integration (35%)

- Payment integration (33%)

- Integration with other back-office tools (30%)

- Integration with ERP/Accounting software (28%)

- Pre-Trip authorization (27%)

There are many other candidates for those in the United Kingdom, Europe, and Asia. If you live and work in one of these regions, you might take a look at Happay, Expensya, Captio (by Emburse), and Pleo.

Below are alternatives to Expensify we’ve used or looked into serving United States organizations supporting U.S. Dollars.

Expensify Alternatives Summary Price Comparison

| Product | Basic Costs / Month | Premium Costs / Month |

|---|---|---|

| Abacus (by Emburse) | $9.00/mo | |

| Certify | $8.00/mo | |

| Concur (SAP) | $8.00/mo (Variable) | Variable |

| Divvy | $0.00/mo (Use their Credit Card) | |

| ExpensePoint | $8.50/mo | |

| Expensify | $4.99/mo | $18.00/mo |

| Fyle | $6.99/mo (Min. 5 users) | $11.99/mo |

| Rydoo | $7.00/mo (Min. 5 users) | $11.00/mo |

| Shoeboxed | $18.00/mo | $54.00/mo |

| TravelBank | $12.00/mo | Variable |

| WebExpenses | $9.00/mo | |

| Zoho Expense | $0.00/mo (Up to 3 users) | $12.00/mo |

NOTE: When a package price could be lowered by paying annually, using their optional credit card, or other incentivized discounts, we chose to list the month-to-month, non-discounted price. Concur (SAP) is based on our member inquiry and you will need to obtain a quote from them.

Don’t forget to read our list of nonprofit software discounts to see if there are discounts for any of these alternatives to Expensify.

So, how much does Expensify cost? If 50% or more of your employees use the Expensify credit card, pricing ranges from $4.99 to $9.00 per user/month. If you don’t want to use the Expensify credit card, which we do not recommend, then pricing is $4.99 – $18.00 per user/month.

Tip – Start Month to Month

When starting with new expense management software, we recommend that smaller organizations start with a month-to-month plan. This allows you to pilot the solution, ensuring it meets your needs before converting to an annual plan. Should you need to move to yet another tool, you will have reduced any potential sunk cost.

Abacus (by Emburse)

Abacus is a great alternative to Expensify. As you would imagine, your team can submit and manage employee expenses in real-time and eliminate the need for paper receipts. Custom approval routing rules at the expense level and policy automation help reduce errors.

We like the minimalistic interface. Employees are presented with only the required information.

The master dashboard provides an overview of all Corporate card transactions in near real-time. You can issue Emburse corporate cards as needed with auto-enforcing rules.

Reporting is solid and allows for the slicing and dicing CFOs and Controllers need.

Virtual cards can be used for ongoing subscriptions or other transactions.

The non-Emburse corporate card sync could be a bit easier. Depending on the complexity of your chart of accounts, the classification of expenses can feel a bit more complex than it should be.

Pricing: $9.00

Pricing Model: Annual or Monthly subscription

Available: Web and Mobile App

Features:

- Corporate Card Integration

- Personal Card Integration

- Automated Policy Enforcement

- Approval Workflow

- Enforce Daily Limits

- Multicurrency

- Custom Fields

- Receipt Management

- SSO/SAML

- Virtual Credit Cards

Integrations:

- Quickbooks Desktop

- Quickbooks Online

- Sage (Export)

- Sage Intacct

- Oracle Netsuite (Export)

- Xero

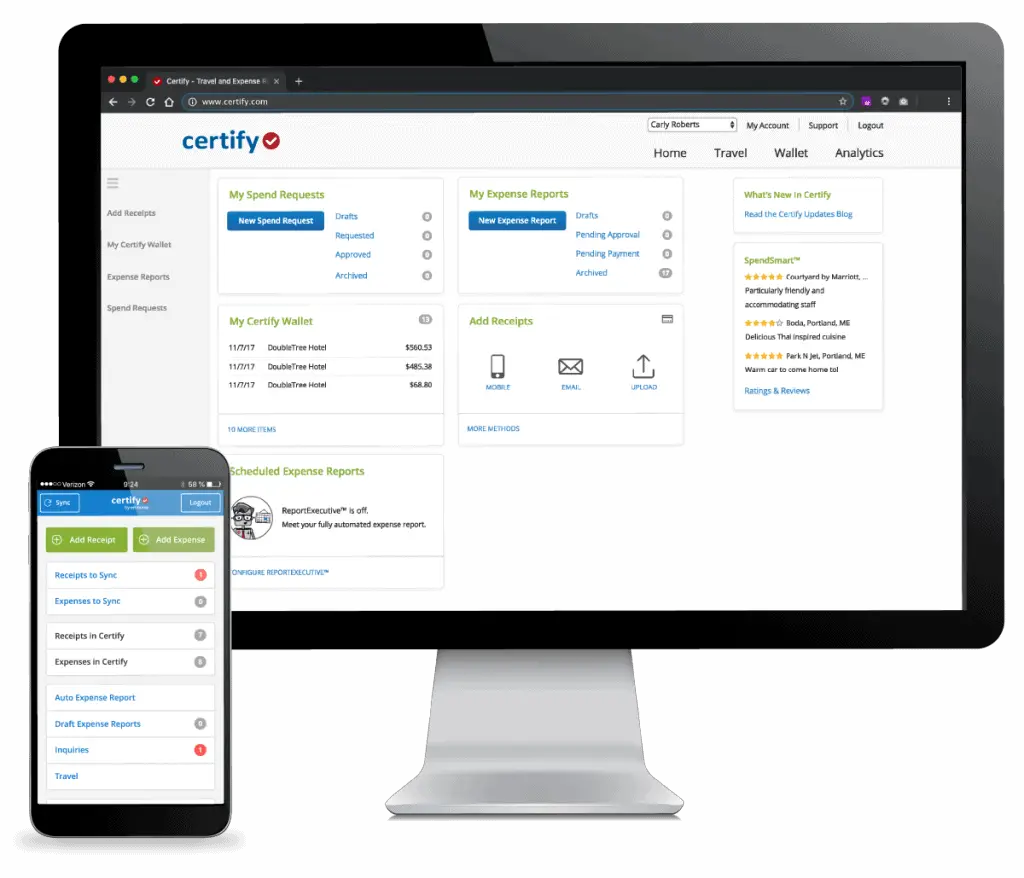

Certify

Another entry in the race is Certify which is a combined travel and expense management tool.

Now, if you want to connect personal and corporate credit cards, you’ll need to be on the Professional plan and requires 25-200 employees.

You can issue physical and virtual credit cards with specific policies and budgets for each user.

Pricing: $8.00 (1-25 Users) / Fixed Fee Monthly (25-200 Users) / Fixed Fee Annual (200+ Users)

Pricing Model: Annual or Monthly subscription

Available: Web and Mobile App

Features:

- Receipt Management

- Automated Expense Report Creation

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Personal Credit Card Integration

- Compliance Capabilities

- Custom Approval Hierarchy

- Real-time Policy Check

- Workflow Management

- Custom Fields

- SSO via SAML

Integrations:

- Oracle Netsuite

- Sage X3

- QuickBooks Online

- QuickBooks Desktop

- PayCor

- Custom integrations for a fee

Concur (SAP)

Another solution from SAP Software, Concur Expense, solves most of your expense management and reimbursement needs. Keep in mind that there are multiple SAP Concur products depending on your needs. For instance, Concur Expense, Concur Travel, and Concur Invoice each tackle different aspects of your financial expense tracking and management. For this comparison, we are looking at Concur Expense.

To get your pricing, you’ll need to request a quote. From what we’ve heard from a handful of clients, it seems to be around $8.00/user/month.

Pricing: $8.00 (Your price may vary)

Pricing Model: Monthly subscription based on a quote

Available: Web and Mobile App

Features:

- Receipt Management

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Custom Approval Hierarchy

- Workflow Management

- Time & Expense Tracking

Integrations:

- QuickBooks Online

- QuickBooks Desktop (Web connector)

- Oracle Netsuite

- Others via 3rd party connectors

Divvy

The pricing model of Divvy is a little different. There is no cost because you must use their credit card. If that’s not a problem for you, this might be a great alternative to Expensify. Check the interest rates on the Business line of credit Divvy offers or be prepared to pay this off monthly.

We like the ability to issue cards as needed including virtual cards.

Splitting transactions requires more clicks than it should.

There are reports of some organizations getting very low credit line limits despite A+ payment history. Your mileage may vary.

2022 Update: We started using Divvy in September 2021 and I must say, we like it a lot. While I was put off originally by having to use their Divvy card, it turned out to be better than what we could get from our own bank. The cards look cool, but that’s just a bonus.

While the automation for reading receipts is not as good as Expensify, it is getting better. Not only does each team member get a card, but we can also create any number of virtual cards for online use. This allows us to save the physical card for in-person meals and travel without risking it for all the other online transactions.

An additional feature that just came available is the ACH payments for staff for reimbursable expenses. Woohoo! Now, staff can submit mileage reimbursements and such using the same process as all other expense tracking. Big win!

Pricing: $0.00 – You must use their credit card

Pricing Model: Free with their credit card use

Available: Web and Mobile App

Features:

- Corporate Card Integration (Divvy Only)

- Automated Policy Enforcement (Budgets)

- Receipt Management

- Approval Workflow

- Virtual Credit Cards

Integrations:

- Quickbooks Desktop

- Quickbooks Online

- Oracle Netsuite

- Xero

ExpensePoint

This is a newer option for us and it is getting some great reviews.

Pricing: $8.50

Pricing Model: Monthly subscription

Available: Web and Mobile App

Features:

- Receipt Management

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Personal Credit Card Integration

- Compliance Capabilities

- Custom Approval Hierarchy

- Workflow Management

- SSO via SAML

Integrations:

- QuickBooks

- Sage

- Great Plains

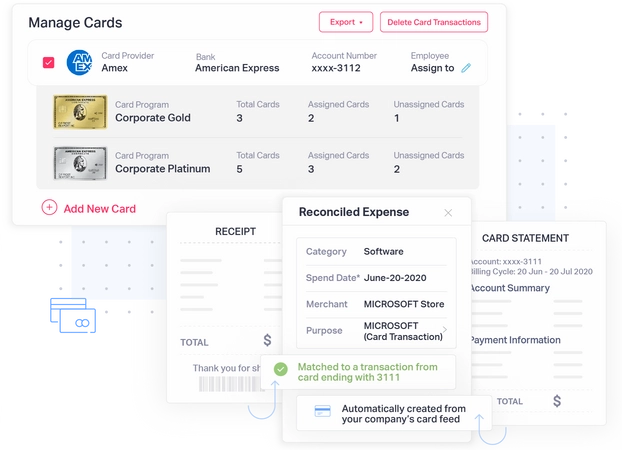

Fyle

Fyle is an expense management solution built for finance teams yet easy enough for easy adoption throughout your entire organization. The automatic completion of expense reports will improve as you use the system through receipt scanning and Artificial Intelligence. Fyle also offers unique discounted offerings to nonprofit, educational, and religious institutions.

If you need Time tracking, Fyle does not have this feature.

Pricing: $6.99 / $11.99 / Custom Large Enterprise

Pricing Model: Annual or Monthly subscription

Available: Web and Mobile App

Features:

- Receipt Management

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Compliance Capabilities

- Custom Approval Hierarchy

- Real-time Policy Check

- Workflow Management

- Custom Fields

- SSO via SAML

Integrations:

- QuickBooks Online

- Sage Intacct

- Financial Force

- Oracle Netsuite

- Xero

- Upside Business Travel

- GSuite

- Office 365

- Slack

Rydoo

With its headquarters in Belgium, Rydoo knows international expense management. In the United States, they have offices in New York.

Approvals of submitted expenses are as simple as swiping to the right to approve and left to deny. Clean and simple.

The Rydoo dashboard is a wonderful, one place for all the summary information about expenses and reimbursements.

There is the Rydoo Travel add-on that allows travel to be booked right within the app with automatic tracking of expenses.

The ability to read the receipt images, OCR, feels a little less accurate at times than some of the other tools on this list.

For small to medium size organizations, this may not be the most effective tool for you but check it out and decide for yourself.

Pricing: $7.00 (0-50 Users) / $11.00 (50+ users) / Enterprise quote (500+)

Pricing Model: Annual or Monthly subscription

Available: Web and Mobile App

Features:

- Receipt Management

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Compliance Capabilities

- Custom Approval Hierarchy

- Policy Checks

- Workflow Management

- Custom Fields

Integrations:

- Oracle Netsuite (Add-on)

- Quickbooks Online

- Xero

- Uber

- Lyft

- Slack

- Microsoft Dynamics

- Exact Online

- Dropbox

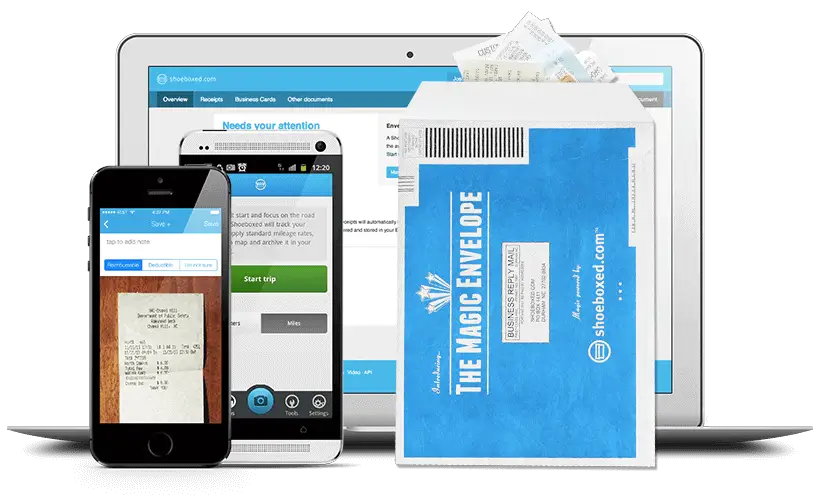

Shoeboxed

Shoeboxed is a little different than the other products on this list. Instead of being a full expense management tool, it is a bit more like a receipt and expense report archive that can export to your accounting system.

Receipts can be scanned and expenses classified into an expense report.

We like the fact that expense reports can be saved/printed with thumbnails of the receipt images, which helps audit compliance.

Another cool feature is the automatic import of Gmail emails that have your purchase receipt.

It is a little disappointing to see limits on the paid-for plans. For example, the StartUp plan is limited to 600 digital documents per year.

A stand-out option is the Magic Envelope™. You grab all the paper receipts off your desk, place them in the envelope and send them off. A few days later, your receipts show up all pretty and entered as expenses in Shoeboxed.

Pricing: $22.00 / $45.00 / $67.00

Pricing Model: Annual or Monthly subscription

Available: Web and iOS only Mobile App

Features:

- Receipt Management

- Expense Reporting

Integrations:

- QuickBooks Online

- Xero (Add-on)

- Evernote

- WorkingPoint

- Bench

TravelBank

This combined travel and expense management tool can also do one or the other.

As you would expect, snap a picture of a receipt and it will become an expense to be classified and submitted on an expense report for approval.

Navigating the approval workflows seems a bit harder than it needs to be in comparison to other tools.

There are a ton of features and unfortunately, the plethora of fields and actions feel a bit cluttered.

A unique feature is the Rewards program. You can set up TravelBank to reward employees who come under budget for expenses by giving them credits on Uber, Lyft, Airbnb, or an Amazon gift card. We can see this being most beneficial to travel expenses.

Pricing: $12.00 / Custom pricing

Pricing Model: Annual or Monthly subscription

Available: Web and Mobile App

Features:

- Receipt Management

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Custom Approval Hierarchy

- Expense Policies

- Workflow Management

- Custom Fields

Integrations:

- Quickbooks Desktop

- Quickbooks Online

- Xero

- Oracle Netsuite

- Workday

- Bill.com

WebExpenses

Another option is based in the United Kingdom and offices in Austin, Texas, and Australia.

For those in the United States, it may feel odd to read and hear “claim” when we are used to the term “expense transaction”. This is pervasive in the tool and the training.

Overall, WebExpenses will get the job done and recent updates are getting high user adoption during the Winter of 2021.

Most of the training videos are a few years old and the web user interface feels a bit dated as well.

The emailing of receipts to WebExpenses to create “claims” is a feature we appreciate.

Pricing: $45.00/mo – Min. 5 Users / Get a custom quote for final pricing

Pricing Model: Monthly subscription

Available: Web and Mobile App

Features:

- Receipt Management

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Custom Approval Hierarchy

- Policy Enforcement

- Workflow Management

- Custom Fields

- SSO via Azure SSO

Integrations:

- Quickbooks Online

- Xero

- Sage Intacct

- Oracle Netsuite

- Sage

- Microsoft Dynamics

- Microsoft Great Plains

Zoho Expense

With up to 3 users, Zoho Expense is free and includes up to 5GB of receipt storage. At the same time, large enterprises can be served well on an Enterprise plan.

Zoho Expense has the features we would want in an expense management tool. The ability to use both corporate and personal credits cards is a must in some organizations and is included here.

The bulk-add feature for expenses is helpful for admins and assistants who do bulk entry of supervisor expenses..

Billable expense reports can even be sent to customers for payment.

The OCR reading of uploaded receipts seems to have difficulty getting the right data at times.

Standard reporting is good, but not having the ability to easily do custom reporting is an oversight.

Travel Requests is a Beta feature and provides the ability for employees to request trip itineraries and expenses for approval prior to booking travel. That’s cool.

Now, you may have a different experience than we did but support was not stellar. Yes, the issue was resolved after a few days, but between some challenges in the communication and time differences, we’d give them a 3 out of 5 stars. This is based on a single experience to take that with a grain of salt.

Pricing: $0.00 (up to 3 users) / $8.00 (3-50 Users) / $12.00 (500+)

Pricing Model: Annual or Monthly subscription

Available: Web and Mobile App

Features:

- Receipt Management

- Multi-currency

- Reimbursement Management

- Corporate Card Integration

- Personal Credit Card Integration

- Compliance Capabilities

- Custom Approval Hierarchy

- Workflow Management

Integrations:

- QuickBooks Online

- QuickBooks Desktop

- Zoho Books

- Xero

Conclusion

If you are looking for an alternative to Expensify, there are good options. Whether you look at Fyle, SAP Concur, Certify, or ExpensePoint, be clear about the integrations and features you need before going all in.

Heck, not being pressured to use their credit card is yet another plus of the above options.

We’re not pretending to have all the answers. Research for yourself and see what works best for you and your team. To make it easy, here is a link to G2 and Capterra to get you started.

Did we miss your favorite expense management software? Tell us in the comments. We’d love to know.

Additional Reading

While we’re on the topic, nonprofit leaders need to look at moving away from using paper checks to reimburse staff and pay bills. Some of the tools above can do some of this. Just be sure you are able to maintain proper internal controls when moving from checks to electronic payments.

On October 23, 2020, Expensify CEO David Barrett sent an email to 10 million Expensify users declaring "anything less than a vote for Biden is a vote against democracy." Let's be clear, NPCrowd.com is not picking a political side. Instead, we have heard our nonprofit members and many are looking for an Expensify alternative as a result of the email.

TravelBank is a great alternative to Expensify and it includes travel management as part of their solution. I’ve found it to be way easier to use then Expensify. And less expensive.

Thanks Jason. We’ll take a look. I appreciate you contributing back to the community in this way.

We’ve updated this post for 2021 and included more in-depth content including adding TravelBank as an option. Thanks!