Divvy vs Expensify: An In-Depth Comparison for Nonprofit Leaders

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

As a nonprofit leader or executive, managing expenses and budgets is essential for your organization’s success. In this article, we’ll dive deeper into the features, benefits, and differences between two popular expense management solutions: Divvy and Expensify. Our goal is to help you make an informed decision on which platform best suits your nonprofit’s needs.Introduction to Divvy and Expensify

Divvy and Expensify are both expense management platforms designed to streamline expense tracking, budgeting, and reimbursement processes for organizations. They offer corporate cards, mobile apps, and web platforms to simplify the management of business expenses.

Features and Benefits of Divvy

Divvy offers a range of features that can help your nonprofit organization manage its finances more effectively:

- Smart Budgets: Create budgets with real-time tracking and customizable limits. You can set budgets on a monthly, quarterly, or yearly basis, and allocate funds to specific departments, projects, or employees.

- Divvy Corporate Cards: Issue physical and virtual cards for employees, volunteers, or projects, with customizable spending limits. Divvy allows you to set rules and restrictions on card usage, such as limiting transactions to certain merchants or categories.

- Expense Reporting: Automatically categorize and tag transactions, simplifying expense reporting and analysis. Divvy also offers customizable receipt capture and the ability to split expenses across multiple categories or projects.

- Integrations: Connect Divvy with your accounting software (QuickBooks, Xero, NetSuite, etc.) or other financial tools to streamline your workflow.

Features and Benefits of Expensify

Expensify also comes with a variety of features to help you manage your nonprofit’s expenses:

- SmartScan: Capture receipts by simply taking a photo, and let Expensify’s AI automatically create the expense report for you, including extracting information like merchant, amount, and category.

- Expensify Corporate Cards: Issue corporate cards with customizable spending limits and automatic expense categorization. Expensify cards offer real-time transaction alerts, fraud detection, and the ability to freeze cards directly from the mobile app.

- Approval Workflows: Set up customizable approval workflows to ensure your organization’s expenses are properly reviewed. You can define multiple approver levels and automatically route expenses to the appropriate approvers based on rules you set.

- Integrations: Seamlessly connect Expensify with your existing accounting software (QuickBooks, Xero, NetSuite, etc.) or other financial tools.

Divvy vs Expensify: Expense Tracking and Budget Management Comparison

Both Divvy and Expensify offer robust expense tracking and budget management features. Divvy’s Smart Budgets provide real-time visibility into your organization’s spending, and the ability to set granular spending limits for departments, projects, or individuals. Expensify’s SmartScan simplifies the process of capturing and categorizing expenses, while its approval workflows help maintain control over expenses by routing them through multiple levels of review.

In terms of budget management, Divvy may have an edge due to its real-time budget tracking and customizable spending limits. However, Expensify’s approval workflows can be equally effective in maintaining control over expenses, particularly for organizations with complex approval chains.

Divvy vs Expensify: Corporate Card Comparison

Divvy and Expensify both offer corporate cards with customizable spending limits. Divvy allows you to issue both physical and virtual cards, while Expensify only offers physical cards. Divvy’s option for virtual cards can be particularly useful for online purchases, subscriptions, or other digital expenses. Both platforms automatically categorize and tag transactions, making it easy to track and analyze spending.

Divvy’s corporate cards offer more granular spending controls, such as limiting transactions to specific merchants or categories, while Expensify cards provide real-time transaction alerts, fraud detection, and the ability to freeze cards directly from the mobile app.

Divvy vs Expensify: Expense Reimbursement Comparison

Divvy provides a direct deposit reimbursement feature, allowing your organization to quickly reimburse employees for approved expenses. Divvy also offers a visual dashboard to monitor the reimbursement process and ensure timely payments. Expensify also supports direct deposit reimbursements, as well as international reimbursements through its integration with TransferWise, making it a suitable option for organizations with global operations.

Pricing Comparison Between Divvy and Expensify

Here’s a comparison table between Divvy and Expensify pricing plans:

| Pricing Plan | Divvy | Expensify |

|---|---|---|

| Free Plan | Yes, unlimited users | Yes, up to 25 SmartScans per month |

| Team Plan | Free | $5 per user per month |

| Corporate Plan | Free | Custom pricing available |

Divvy’s free plan offers unlimited users, while Expensify’s free plan only allows up to 25 SmartScans per month. In fact, Divvy is free to use to manage budgets, control spending, track expenses, and more within Divvy.

Seems like Divvy is a clear winner here!

Customer Support Comparison Between Divvy and Expensify

Divvy provides phone, email, and chat support, as well as a comprehensive help center with articles and video tutorials. In my experience, both phone and chat support with Divvy has been excellent, with timely responses and a thorough understanding of our requests. Their customer support team is knowledgeable and committed to resolving any issues promptly.

Expensify offers email and chat support, along with a help center featuring articles and guides. I have used Expensify’s chat support and found it helpful for easy answers that can also be resolved through their knowledge base. However, for more complex questions, the path to resolution involved “escalating” to another tier of support, which led to a handoff to someone else, and it could take 24-28 hours before a response came through. This can be frustrating when your team is experiencing a problem that needs immediate attention.

Both platforms place a strong emphasis on providing quality customer support, but Divvy’s support is more responsive when it comes to addressing more complex issues quickly.

User Experience Comparison Between Divvy and Expensify

Both Divvy and Expensify offer intuitive user interfaces, mobile apps, and web platforms, making it easy for your team to manage expenses on the go. In this section, we’ll dive deeper into the user experience, focusing on the mobile apps and receipt-matching capabilities of both platforms.

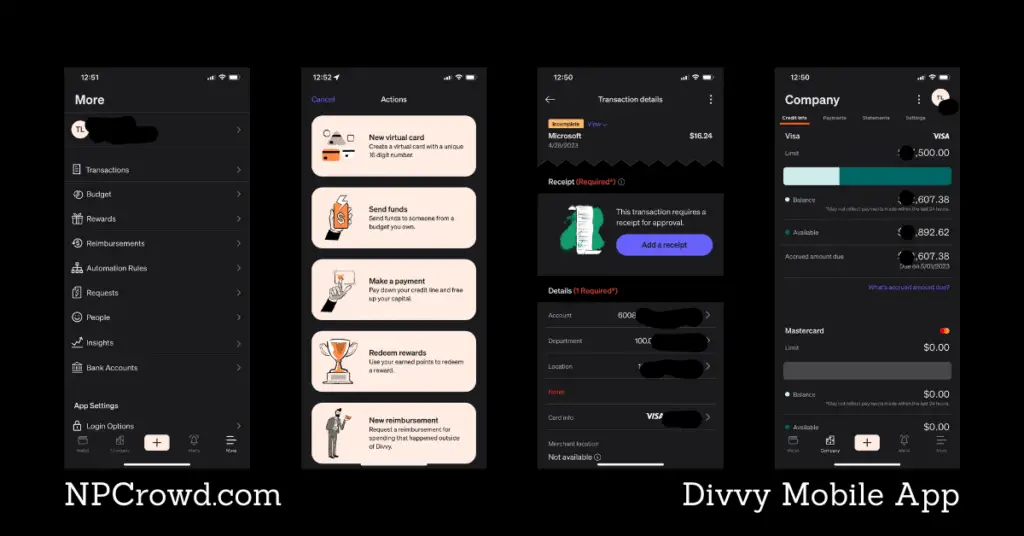

Mobile Apps

Divvy Mobile App: Divvy’s mobile app is known for its clean and modern design. It allows users to view their transactions, capture receipts, submit expense reports, and manage budgets in real time. Users can also request funds or approve requests from others, making it easy to stay on top of budget allocations and spending approvals while on the go.

Expensify Mobile App: Expensify’s mobile app is user-friendly and straightforward, offering a seamless experience for capturing receipts, creating and submitting expense reports, and managing corporate cards. It also provides real-time transaction alerts and the ability to freeze cards directly from the app, ensuring that users have full control over their expenses even when away from their computers.

Receipt Matching

While both Divvy and Expensify offer receipt capture and expense categorization features, Expensify has an edge when it comes to receipt matching. Expensify’s SmartScan technology automatically matches receipts to the corresponding transactions, making it easy for users to quickly create accurate expense reports. This feature minimizes manual work and reduces the likelihood of errors or discrepancies in expense reporting.

On the other hand, Divvy’s receipt capture is not as advanced as Expensify’s at the present time. Users might need to spend more time manually matching receipts to transactions, which could increase the potential for errors or inconsistencies in expense reporting.

Ultimately, the choice between Divvy and Expensify may come down to personal preference or specific feature requirements. If receipt matching is a priority for your organization, Expensify’s superior capabilities in this area may be a deciding factor. However, if real-time budget tracking and spending controls are more important, Divvy’s robust budgeting features and the mobile app might outweigh the advantage of Expensify’s receipt matching.

Final Verdict: Which One is Right for You?

Choosing between Divvy and Expensify ultimately depends on your nonprofit organization’s specific needs and priorities. If real-time budget tracking and the option for virtual cards are important, Divvy may be the better choice. On the other hand, if your organization requires a more robust approval workflow system and a pay-per-use pricing model, Expensify might be the better fit.

Personally, I’ve chosen Divvy for the nonprofits I work with because of its cost, real-time budget tracking, customizable spending limits, and the convenience of virtual cards. However, one caution about Divvy is that the fraud protection for their corporate credit cards is serious. Upon detecting potential fraud, the corporate card is locked down, and it can take 5-14 days to receive a new physical card. The good thing is that you can still manage and use virtual cards during this time, minimizing disruptions to your organization’s operations.

Conclusion

Divvy and Expensify both offer powerful expense management solutions for nonprofit leaders and executives. By comparing their features, benefits, pricing, and user experiences, you can make an informed decision about which platform is best suited for your organization. Keep your nonprofit’s unique needs and priorities in mind as you evaluate Divvy and Expensify, and feel confident knowing that either platform can help streamline your expense management process.