Understanding Net Assets in the Nonprofit Sector

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

Net assets are a crucial concept in the nonprofit sector. Unlike for-profit businesses, nonprofits do not have owner’s equity or retained earnings. Instead, net assets represent the difference between what the organization owns and owes. In this article, we will explore the definition of net assets, the types of net assets, and their importance in the nonprofit sector. We will also discuss how to calculate net assets and the key strategies for managing them effectively. Finally, we will examine the challenges that nonprofits face in net asset management. By understanding net assets and implementing effective management strategies, nonprofits can ensure their financial health and long-term sustainability.Key Takeaways

- Net assets represent the difference between what a nonprofit organization owns and owes.

- There are two main types of net assets: unrestricted and restricted.

- Net assets are crucial for nonprofits as they indicate the organization’s financial health and sustainability.

- Calculating net assets involves subtracting liabilities from total assets.

- Managing net assets requires effective budgeting, investment strategies, fundraising, and financial reporting.

What are Net Assets?

Defining Net Assets

Net assets are a key financial metric used in the nonprofit sector to measure the organization’s financial health and sustainability. They represent the residual interest in the organization’s assets after deducting liabilities. In simpler terms, net assets are the organization’s total assets minus its total liabilities. Net assets can be further categorized into two types: unrestricted net assets and restricted net assets.

Unrestricted net assets are the

Types of Net Assets

Net assets in nonprofit organizations can be classified into three main types: unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets. Let’s take a closer look at each type:

Unrestricted Net Assets: These are the funds that are not subject to any donor-imposed restrictions. Nonprofits have the flexibility to use these assets for any purpose that aligns with their mission and objectives.

Temporarily Restricted Net Assets: These are funds that have specific restrictions imposed by donors. These restrictions may be time-bound or project-specific. Nonprofits can only use these assets for the designated purpose until the restrictions are lifted.

Permanently Restricted Net Assets: These are funds that have permanent restrictions imposed by donors. The principal amount of these assets is preserved, and only the investment income can be used for the organization’s operations. These assets are typically designated for long-term projects or endowments.

Importance of Net Assets

Net assets are a crucial financial metric for nonprofit organizations. They represent the residual value of an organization’s assets after deducting liabilities. In simple terms, net assets reflect the organization’s financial health and sustainability.

One important aspect of net assets is the distinction between unrestricted and restricted net assets. Unrestricted net assets are available for general use and can be used to cover operating expenses, invest in new initiatives, and support the organization’s overall mission. On the other hand, restricted net assets are designated for specific purposes as defined by the donor.

Analyzing the ratio of net assets to total assets can provide insights into a nonprofit’s financial health. However, it is important to consider the variability and lack of correlation across different ratios. Net assets ensure that funds are used for their intended purpose and play a crucial role in the long-term success and impact of nonprofit organizations.

Calculating Net Assets

Assets

Assets are things your nonprofit owns. This includes the cash in your bank account, the furniture and equipment in your office, and the real estate your organization may own. Assets are an important component of net assets as they contribute to the overall financial value of the organization. When calculating net assets, it is crucial to accurately assess the value of each asset and include it in the calculation.

Liabilities

Liabilities refer to the sum of all debts and obligations that a nonprofit organization owes to external parties. This includes loans, accounts payable, accrued expenses, and other financial obligations. It is an important financial metric that helps assess the organization’s financial health and its ability to meet its obligations. Understanding the total liabilities is crucial for effective financial management. By accurately tracking and managing these liabilities, nonprofits can ensure that they have enough resources to cover their debts and maintain a positive cash flow. It also helps assess the value of each asset and include it in the calculation.

Equity

Equity is a crucial component of net assets in nonprofit organizations. It represents the residual interest in the organization’s assets after deducting liabilities. In simple terms, it is the organization’s net worth or the value that would be left if all debts were paid off. Equity is an important indicator of the financial health and stability of a nonprofit organization.

Net Assets Formula

The net assets formula is a key tool for assessing the financial stability and capacity of a nonprofit organization. It provides a snapshot of the organization’s financial position by subtracting total liabilities from total assets. This formula, Net Assets = Total Assets – Total Liabilities, helps stakeholders understand the organization’s net worth at a specific point in time. By calculating net assets, nonprofit organizations can evaluate their financial health and their ability to fulfill their mission.

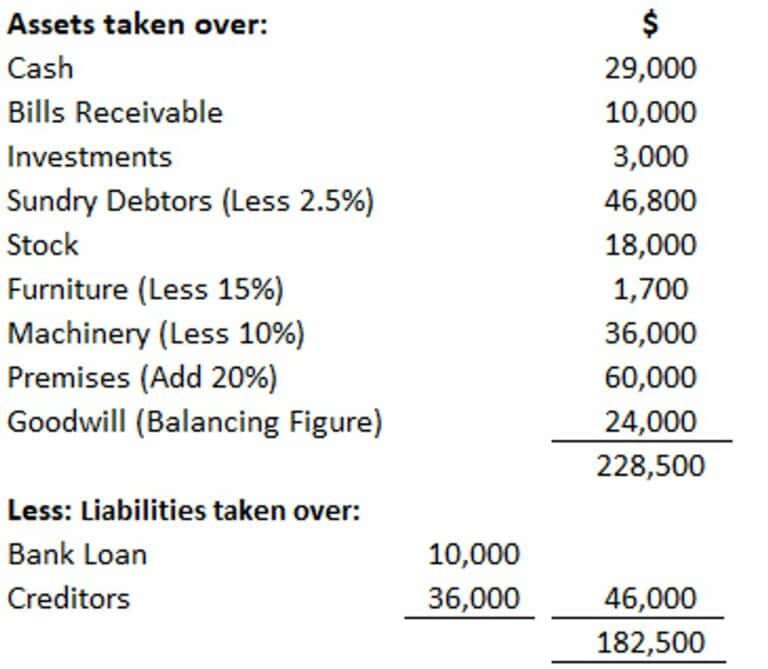

To calculate net assets, you need to know the total assets and total liabilities of the organization. Total assets include all the resources owned by the organization, such as cash, investments, property, and equipment. Total liabilities include all the debts and obligations of the organization, such as loans, accounts payable, and accrued expenses. Once you have these figures, you can use the net assets formula to determine the net assets.

It’s important for nonprofit organizations to effectively manage their net assets to ensure long-term sustainability. This involves budgeting and financial planning to allocate resources efficiently, implementing investment strategies to generate returns and grow net assets, and maintaining strong fundraising and donor relations to secure additional funding. By understanding and actively managing net assets, nonprofits can strengthen their financial stability and support their mission.

Managing Net Assets

Budgeting

Nonprofits can make smart choices based on their budget and goals, ensuring that resources are allocated effectively. Budgeting and forecasting are both essential components of nonprofit accounting. Budgeting involves planning for predicted revenues in the future, while forecasting anticipates future income. Implementing a budget helps organizations achieve their goals, manage cash flow, and fulfill their fiduciary responsibilities. Forecasts provide insights into future financial performance and help organizations adapt and make informed decisions.

When developing a budget, nonprofits should consider various expenses, including programmatic costs, administrative costs, overhead expenses, fundraising costs, and personnel/staff costs. It is important to set up clear financial policies and procedures that outline how financial transactions will be handled, including approvals, record keeping, and reporting. By establishing these policies, nonprofits can ensure financial accountability and build trust with supporters and demonstrates a commitment to accountability.

In addition to compliance and transparency, financial planning contributes to the long-term sustainability of nonprofit organizations. By creating reserves, managing cash flow, and preparing for unforeseen circumstances, organizations can weather economic fluctuations and unexpected challenges. Strategic decision-making is also facilitated by proper fiscal management. Nonprofits can make smart choices based on their budget and goals, ensuring that resources are allocated effectively.

Investment Strategies

Investment strategies play a crucial role in managing net assets for nonprofit organizations. By carefully considering the organization’s financial goals and the sector’s context, nonprofits can make informed investment decisions that optimize their resources and create meaningful impact.

One important aspect of investment strategies is transparency. Donors and stakeholders want to know how their funds are being invested and the impact they are making. Nonprofits should provide regular updates and reports on their investment activities, highlighting the outcomes achieved and the alignment with their mission.

Additionally, being nimble in decision-making is essential. Economic conditions and investment opportunities can change rapidly, and nonprofits need to adapt their strategies accordingly to maximize returns.

Lastly, it’s important for nonprofits to prioritize accountability in their investment strategies. By aligning investments with the organization’s goals and objectives, nonprofits can ensure that their net assets are being used effectively and in accordance with their mission.

Fundraising

Fundraising is a crucial aspect of running a nonprofit organization. It allows nonprofits to secure the necessary funds to support their missions and make a positive impact in their communities. However, fundraising can be a challenging endeavor for many nonprofits. They often face limited resources, competition for donor dollars, and the need to continuously adapt.

To maximize fundraising potential, nonprofits can consider the following strategies:

- Utilize donor management software to streamline giving processes, deepen donor relationships, and support more effective engagement strategies.

- Integrate customer relationship management (CRM) and fundraising platforms to enhance accuracy and quickly respond to accounting challenges.

- Collect and analyze donor-focused financial metrics, such as retention rates and contribution trends, to cultivate stronger relationships with donors and drive fundraising efforts.

Remember, strong donor relationships are built on trust, communication, and demonstrating the impact of donations. By implementing these strategies, nonprofits can

Financial Reporting

Financial reporting is an essential aspect of nonprofit organizations. It involves tracking and reporting the financial performance of the organization over a specific period or up to a certain date. Nonprofits prepare three main financial statements: the Statement of Financial Position, the Statement of Activities, and the Statement of Cash Flows. The Statement of Financial Position provides an analysis of the organization’s total assets, total liabilities, and net assets, giving stakeholders a clear overview of the nonprofit’s financial health.

Challenges in Net Asset Management

Market Volatility

Market volatility is one of the major challenges in managing net assets in the nonprofit sector. The unpredictable nature of the financial markets can have a significant impact on the value of investments and assets held by nonprofits. Fluctuations in stock prices, interest rates, and exchange rates can result in gains or losses for the organization. Nonprofits need to carefully monitor market trends and adjust their investment strategies accordingly to mitigate the risks associated with market volatility.

Donor Restrictions

Donor restrictions are an important aspect of managing net assets in the nonprofit sector. Nonprofits often receive funds that come with specific restrictions imposed by donors. These restrictions dictate how the funds can be used and for what purposes. It is crucial for nonprofits to understand and comply with these restrictions in order to effectively plan for the use of these funds.

There are two types of donor restrictions: temporarily restricted net assets and permanently restricted net assets.

Temporarily Restricted Net Assets: These are funds that have specific restrictions imposed by donors for a limited period of time. Nonprofits must use these assets in accordance with the donor’s specified purpose or wait until the restriction is lifted.

Permanently Restricted Net Assets: These are funds that have permanent restrictions imposed by donors. The principal amount of these assets is typically invested, and only the income generated from the investments can be used for specific purposes as defined by the donor.

Managing donor restrictions requires careful record-keeping and monitoring of expiration dates. Nonprofits must ensure that the funds are allocated to the designated purposes and not used for general operating expenses or other purposes. By effectively managing donor restrictions, nonprofits can ensure that they are fulfilling the intentions of the donors and maintaining financial sustainability.

Sustainability

Sustainability is a key consideration for nonprofit organizations when managing their net assets. It involves ensuring the long-term financial stability and viability of the organization. Nonprofits need to develop sustainable cost management strategies to effectively allocate their resources and minimize expenses. This may include implementing efficient budgeting processes, exploring alternative revenue streams, and optimizing operational efficiency. By prioritizing sustainability, nonprofits can better weather financial challenges and maintain their mission-driven work for years to come.

Compliance

Compliance with accounting and tax rules is essential for nonprofits to maintain their tax-exempt status. Nonprofits must adhere to Generally Accepted Accounting Principles (GAAP) and follow specialized fund accounting guidance. Rigorous recordkeeping is necessary to track program spending and administrative costs. Compliance not only ensures tax compliance but also helps build public trust and confidence. By demonstrating fiscal responsibility, nonprofits can earn the trust of donors and strengthen their ability to further their mission.

- Nonprofits must adhere to accounting and tax rules

- Rigorous recordkeeping is necessary

- Compliance helps build public trust and confidence

- Demonstrating fiscal responsibility strengthens donor trust

Tip: Ensure accurate and detailed recordkeeping to maintain compliance and build trust with stakeholders.

Frequently Asked Questions

What are net assets?

Net assets represent the difference between what a nonprofit organization owns and owes.

What are the types of net assets?

There are two main types of net assets: unrestricted and restricted.

Why are net assets important for nonprofits?

Net assets are crucial for nonprofits as they indicate the organization’s financial health and sustainability.

How do you calculate net assets?

Net assets can be calculated by subtracting liabilities from total assets.

What is the difference between unrestricted and restricted net assets?

Unrestricted net assets can be used for any purpose, while restricted net assets have specific limitations set by donors.

What are the challenges in net asset management?

Some challenges in net asset management include market volatility, donor restrictions, sustainability, and compliance.