Maximizing Net Assets for Nonprofit Organizations

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

Nonprofit organizations play a crucial role in society by addressing social issues and providing valuable services to communities. However, in order to effectively fulfill their missions, nonprofits need to have strong financial foundations. Maximizing net assets is essential for nonprofit organizations to ensure financial stability and sustainability. In this article, we will explore the importance of net assets for nonprofits and strategies to maximize them. We will also discuss the significance of building strong financial reserves and ensuring financial sustainability through budgeting and financial planning. By implementing these practices, nonprofits can enhance their financial well-being and make a greater impact on the communities they serve.Key Takeaways

- Understanding and effectively managing net assets is crucial for the financial stability and sustainability of nonprofit organizations.

- Diversifying revenue streams can help nonprofits reduce reliance on a single funding source and increase their net assets.

- Implementing effective fundraising techniques, such as donor cultivation and grant writing, can contribute to maximizing net assets.

- Optimizing operational efficiency through cost-saving measures and strategic resource allocation can improve net assets.

- Creating a reserve policy and investing reserves wisely are essential for building strong financial reserves and ensuring financial stability.

Understanding the Importance of Net Assets

What are Net Assets?

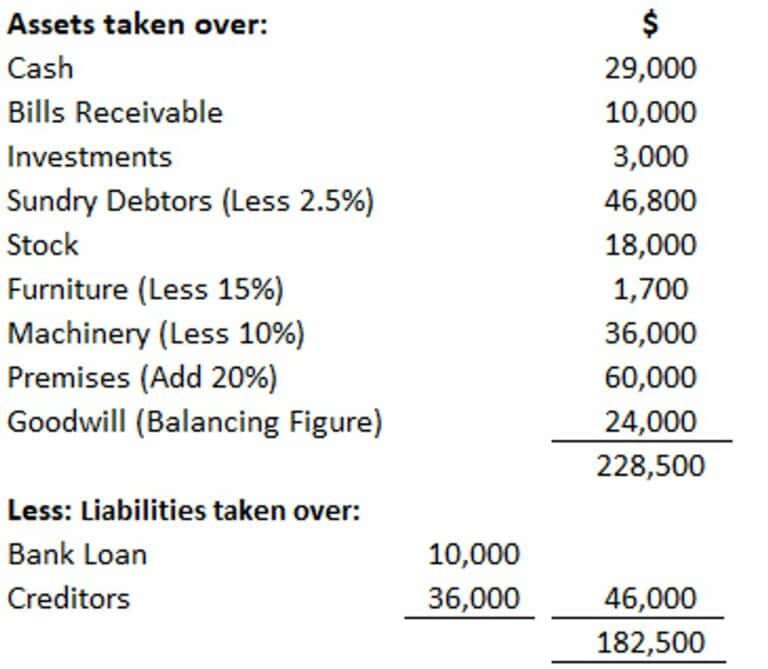

Net assets are the total assets of an entity, minus its total liabilities. It represents the residual interest in the organization’s assets after deducting its liabilities. In simpler terms, net assets are what remains when all debts and obligations are settled. It is an important financial indicator for nonprofit organizations as it reflects the organization’s financial health and sustainability. Nonprofit organizations strive to maximize their net assets to ensure long-term viability and fulfill their mission.

Why Net Assets Matter for Nonprofit Organizations

Net assets are a crucial component of a nonprofit organization’s financial health. They represent the total value of the organization’s assets minus its liabilities. Net assets provide a measure of the organization’s financial strength and stability, indicating its ability to fulfill its mission and sustain its operations.

Having a positive net asset balance is essential for nonprofit organizations as it demonstrates their ability to generate revenue, manage expenses, and invest in future growth. It also allows them to weather financial challenges and uncertainties.

Maximizing net assets is a priority for nonprofit organizations as it enables them to expand their impact, support their programs and services, and build a strong foundation for long-term sustainability.

To achieve this, nonprofits employ various strategies such as diversifying revenue streams, implementing effective fundraising techniques, and optimizing operational efficiency. By doing so, they can increase their net assets and ensure financial stability for the future.

Strategies for Maximizing Net Assets

Diversifying Revenue Streams

To maximize net assets, nonprofit organizations should consider diversifying their revenue streams. Avoid over-reliance on a single nonprofit funding source to ensure a steady and reliable inflow of funds. Incorporating grants, donations, events, and corporate partnerships into your revenue can help create a more sustainable financial model.

Implementing a diversified revenue strategy can provide stability and flexibility for your organization. Here are some key steps to consider:

- Grants: Explore opportunities for grant funding from foundations, government agencies, and other organizations that align with your mission.

- Donations: Cultivate relationships with individual donors and encourage regular giving through campaigns and fundraising events.

- Events: Host fundraising events such as galas, auctions, or charity runs to engage the community and generate revenue.

- Corporate Partnerships: Seek partnerships with businesses that share your values and can provide financial support or in-kind contributions.

By diversifying revenue sources, nonprofit organizations can reduce the risk of relying too heavily on one funding stream and increase their financial sustainability. Remember to regularly review and adjust your revenue strategy to adapt to changing circumstances and maximize net assets.

Effective Fundraising Techniques

Effective fundraising is crucial for nonprofit organizations to sustain their operations and achieve their missions. It involves engaging donors and supporters to contribute financial resources that will support the organization’s programs and initiatives. There are several key techniques that can help maximize fundraising efforts:

Optimizing Operational Efficiency

Optimizing operational efficiency is crucial for nonprofit organizations to maximize their net assets. By streamlining processes and eliminating unnecessary steps, nonprofits can reduce costs and allocate resources more effectively. One strategy to achieve operational efficiency is to leverage technology solutions that automate manual tasks and improve productivity. This can include using project management software, donor management systems, and online fundraising platforms. Additionally, nonprofits can optimize their staffing structure by identifying roles and responsibilities that can be consolidated or outsourced, allowing staff members to focus on high-value activities. By continuously evaluating and improving operational processes, nonprofits can ensure that their resources are used efficiently to support their mission and increase their net assets.

Building Strong Financial Reserves

Creating a Reserve Policy

Creating a reserve policy is a crucial step for nonprofit organizations to ensure financial stability and long-term sustainability. A reserve policy outlines guidelines for building and maintaining adequate reserves to cover unexpected expenses, changes in funding, or global obstacles like a recession. It provides a roadmap for managing financial risks and helps organizations navigate uncertain times with confidence.

Implementing a reserve policy involves several key steps:

-

Assessing the organization’s financial needs and risks: Before creating a reserve policy, it’s important to evaluate the organization’s financial situation, identify potential risks, and determine the appropriate level of reserves.

-

Setting reserve targets: Based on the assessment, establish specific targets for the amount of reserves the organization should aim to have. These targets should take into account the organization’s operating expenses, revenue sources, and potential risks.

-

Defining reserve utilization guidelines: Clearly define the circumstances under which reserves can be utilized, such as emergencies, unexpected expenses, or changes in funding. This ensures that reserves are used strategically and in alignment with the organization’s goals.

-

Monitoring and reviewing reserves: Regularly monitor and review the organization’s reserves to ensure they are being maintained at the desired level. Adjustments may need to be made based on changes in the organization’s financial situation or external factors.

By creating a reserve policy and following it diligently, nonprofit organizations can build a strong financial foundation and ensure their long-term financial sustainability.

Investing Reserves Wisely

Investing reserves wisely is a crucial aspect of financial management for nonprofit organizations. By making strategic investment decisions, nonprofits can enhance their financial stability and diversify their revenue sources. These investments can provide a steady stream of income that can support the organization’s mission and programs.

One important consideration when investing reserves is to ensure that the investments align with the organization’s values and goals. Nonprofits should carefully evaluate potential investment opportunities and choose those that align with their mission and do not compromise their ethical standards.

Additionally, it is important for nonprofits to regularly monitor and evaluate the performance of their investments. This allows them to make informed decisions and adjust their investment strategies if necessary. By staying proactive and vigilant, nonprofits can maximize the returns on their reserves and ensure long-term financial sustainability.

In summary, investing reserves wisely is a key component of financial management for nonprofit organizations. It allows them to diversify their revenue sources, support their mission, and ensure long-term financial stability.

Ensuring Financial Sustainability

Budgeting and Financial Planning

Budgeting and financial planning are crucial for the long-term sustainability and success of nonprofit organizations. A well-developed financial plan helps nonprofits allocate their limited resources efficiently, maximizing the impact of their programs and initiatives. It also ensures compliance with nonprofit accounting standards, tax regulations, and reporting obligations, preventing legal issues and maintaining the organization’s tax-exempt status. Transparent and responsible financial management builds trust with supporters, showcasing a commitment to accountability. Viable financial planning involves creating reserves, managing cash flow, and preparing for unforeseen circumstances, which is critical for weathering economic fluctuations or unexpected challenges. Proper fiscal management enables organizations to make strategic decisions based on their budget and goals.

Monitoring and Evaluating Financial Performance

Performance tracking is essential for nonprofit organizations to ensure financial sustainability and make informed decisions. By regularly monitoring and evaluating financial performance, organizations can track their progress, identify areas for improvement, and make necessary adjustments. Here are some key steps to effectively monitor and evaluate financial performance:

- Pull reports: Regularly pull reports from your accounting software and nonprofit CRM to analyze income, expenses, and other related activities.

- Create a financial calendar: Outline key dates for budgeting, reporting, and financial reviews to ensure timely and organized fiscal activities.

- Invest in tech: Choose and implement accounting software suitable for your organization’s needs to streamline financial information and reporting.

- Work with a dedicated financial team: Assemble a core group responsible for fiscal strategy and management, including individuals with financial expertise.

Remember, nonprofit financial planning should be an ongoing process, not just an annual occurrence. By consistently monitoring and evaluating financial performance, organizations can stay on track and ensure long-term financial sustainability.

Frequently Asked Questions

What are net assets?

Net assets are the total assets of a nonprofit organization minus its total liabilities. They represent the organization’s financial resources that are available for use in carrying out its mission.

Why do net assets matter for nonprofit organizations?

Net assets are important for nonprofit organizations because they provide a measure of the organization’s financial stability and sustainability. They can be used to fund ongoing programs and activities, invest in future growth, and build reserves for unexpected expenses.

How can nonprofit organizations diversify their revenue streams?

Nonprofit organizations can diversify their revenue streams by exploring different sources of funding, such as grants, donations, fundraising events, corporate sponsorships, and earned income ventures. By relying on multiple sources of income, organizations can reduce their dependence on a single funding source.

What are some effective fundraising techniques for nonprofit organizations?

Some effective fundraising techniques for nonprofit organizations include developing a compelling case for support, engaging with donors through personalized communication, leveraging social media and online platforms, organizing fundraising events, and cultivating long-term relationships with donors.

How can nonprofit organizations optimize operational efficiency?

Nonprofit organizations can optimize operational efficiency by implementing effective financial management practices, streamlining administrative processes, leveraging technology and automation, investing in staff training and development, and regularly evaluating and improving organizational systems and workflows.

What is a reserve policy for nonprofit organizations?

A reserve policy is a financial management tool that outlines guidelines for building and maintaining financial reserves. It typically includes criteria for determining the appropriate level of reserves, guidelines for using reserves, and strategies for replenishing reserves when necessary.