Understanding Net Assets in Nonprofit Organizations: A Guide for Stakeholders

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

Net assets play a crucial role in the financial management of nonprofit organizations. Unlike for-profit businesses, nonprofits do not have owner’s equity or retained earnings. Instead, net assets represent the difference between what the organization owns and owes. Understanding net assets is important for stakeholders such as donors, board members, and employees. In this article, we will explore the definition and types of net assets, how they are calculated, their role in financial reporting, and the implications for stakeholders.Key Takeaways

- Net assets represent the difference between what a nonprofit organization owns and owes.

- There are three types of net assets: unrestricted, temporarily restricted, and permanently restricted.

- Net assets are calculated by subtracting liabilities from assets.

- Net assets are reported in the statement of financial position, statement of activities, and statement of cash flows.

- Net assets have implications for stakeholders such as donors, board members, and employees.

What are Net Assets?

Definition of Net Assets

Net assets are a key financial metric for nonprofit organizations. They represent the difference between the total assets and total liabilities of an organization. In other words, net assets are what remains when all debts and obligations are subtracted from the value of the organization’s assets. It is important to note that nonprofits do not have owner’s equity or retained earnings like for-profit businesses. Instead, the difference between what the organization owns and owes is referred to as net assets.

Types of Net Assets

Net assets in nonprofit organizations can be classified into three main types: unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets. Let’s take a closer look at each type:

-

Unrestricted Net Assets: These are the funds that are not subject to any donor-imposed restrictions. Nonprofits have the flexibility to use these assets for any purpose that aligns with their mission and objectives.

-

Temporarily Restricted Net Assets: These are funds that have specific restrictions imposed by donors for a limited period of time. Nonprofits must use these assets in accordance with the donor’s specified purpose or wait until the restriction is lifted.

-

Permanently Restricted Net Assets: These are funds that have permanent restrictions imposed by donors. The principal amount of these assets is typically invested, and only the income generated from the investments can be used for specific purposes as defined by the donor.

Importance of Net Assets in Nonprofit Organizations

Net assets play a crucial role in the financial health and sustainability of nonprofit organizations. Unlike for-profit businesses, nonprofits do not have owner’s equity or retained earnings. Instead, the difference between what the organization owns and owes is referred to as net assets. These assets represent the organization’s financial resources that can be used to support its mission and programs.

One important aspect of net assets is ensuring the appropriate use of donations and grants. Nonprofit revenue is typically derived from member dues, donations, and grants. Donors and funders want to ensure that their contributions are being used effectively and in line with their intended purpose. By tracking and managing net assets, nonprofits can demonstrate transparency and accountability to their stakeholders.

Additionally, net assets are important for financial reporting. Nonprofit financial reports, such as the Statement of Financial Position, provide a snapshot of the organization’s financial stability. These reports are used by donors, grantors, board members, and management to assess the organization’s financial health and make informed decisions.

In summary, net assets are a vital component of nonprofit organizations. They represent the organization’s financial resources and are essential for supporting its mission, ensuring the appropriate use of donations and grants, and providing transparency to stakeholders.

Understanding the Components of Net Assets

Unrestricted Net Assets

From a broad perspective, unrestricted net assets refer to funds that an organization can use at its discretion to support its mission and operations. These funds are not subject to any donor-imposed restrictions and can be used for any purpose deemed necessary by the nonprofit. Unrestricted net assets are an essential component of a nonprofit’s financial health as they provide flexibility and stability in managing day-to-day operations and pursuing long-term goals. They serve as a safety net that allows the organization to respond to unforeseen challenges and seize opportunities for growth.

Temporarily Restricted Net Assets

Temporarily restricted net assets are a crucial component of a nonprofit organization’s financial position. These are funds that have been designated for specific purposes by donors or grantors, but their restrictions are time-limited. In other words, there is a predetermined period during which the funds must be used for the intended purpose.

One example of temporarily restricted net assets is a grant that is awarded to a nonprofit for a specific project. The grant agreement may specify that the funds can only be used for that project and must be spent within a certain timeframe. During this period, the funds are classified as temporarily restricted net assets.

It is important for nonprofit organizations to carefully track and manage their temporarily restricted net assets to ensure compliance with donor restrictions and to effectively plan for the use of these funds. This includes maintaining accurate records of the restrictions, monitoring the expiration dates of the restrictions, and appropriately allocating the funds to the designated purposes.

Permanently Restricted Net Assets

Permanently restricted net assets are a vital component of a nonprofit organization’s financial structure. These assets are funds that have been donated to the organization with specific restrictions that they must be maintained in perpetuity. They cannot be used for general operating expenses or other purposes. Instead, they are set aside for specific programs, projects, or initiatives that align with the donor’s intentions.

Permanently restricted net assets are typically established through endowments or other long-term funding arrangements. These funds provide a stable and reliable source of income for the organization, ensuring its long-term sustainability and ability to fulfill its mission.

It is important for nonprofit stakeholders to understand the significance of permanently restricted net assets. These assets represent a commitment from donors to support the organization’s work over the long term. They provide a sense of stability and security, allowing the organization to plan for the future and invest in impactful initiatives.

Key Highlight: Funds in this category are set aside indefinitely.

How Net Assets are Calculated

Assets

Assets are things your nonprofit owns. This includes the cash in your bank account, the furniture and equipment in your office, and the real estate your organization may own. Assets are an important component of net assets as they contribute to the overall financial value of the organization. When calculating net assets, it is crucial to accurately assess the value of each asset and include it in the calculation.

Liabilities

Liabilities are the financial obligations or debts that a nonprofit organization owes to external parties. These can include loans, accounts payable, accrued expenses, and other liabilities. It is important for nonprofits to accurately record and track their liabilities to ensure financial transparency and accountability. Failure to properly manage liabilities can lead to financial difficulties and potential legal issues. Nonprofits should regularly review and analyze their liabilities to make informed financial decisions and mitigate risks.

Equity

Equity is a crucial component of net assets in nonprofit organizations. It represents the residual interest in the organization’s assets after deducting liabilities. In simple terms, it is the organization’s net worth or the value that would be left if all debts were paid off. Equity is an important indicator of the financial health and stability of a nonprofit organization.

The Role of Net Assets in Financial Reporting

Statement of Financial Position

The Statement of Financial Position, also known as the balance sheet, is a crucial component of nonprofit financial statements. It provides a snapshot of the organization’s assets, liabilities, and net assets at a specific point in time. This statement helps stakeholders understand the financial health of the nonprofit and its ability to meet its obligations.

In the Statement of Financial Position, you will find the total assets, which include both tangible and intangible resources owned by the organization. These assets can include cash, investments, property, equipment, and more. On the other hand, liabilities represent the organization’s debts and obligations, such as loans, accounts payable, and accrued expenses.

The net assets section of the statement is particularly important. It shows the difference between the total assets and liabilities, indicating the organization’s overall financial position. Net assets are further broken down into different categories, including net assets with and without donor restrictions. This breakdown provides insights into the availability and restrictions placed on the organization’s resources.

It’s essential for stakeholders to carefully review the Statement of Financial Position to assess the nonprofit’s financial stability and make informed decisions. By understanding the organization’s assets, liabilities, and net assets, stakeholders can evaluate its ability to fulfill its mission and sustain its operations.

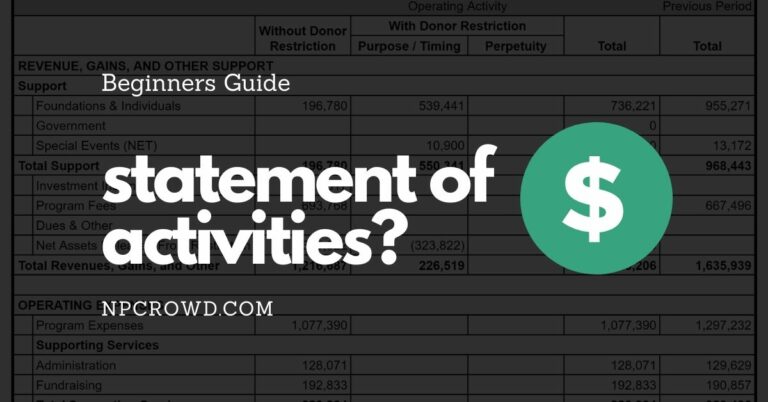

Statement of Activities

The Statement of Activities is an important financial statement for nonprofit organizations. It provides a detailed overview of the revenue and expenses of the organization for a specific reporting period. This statement compares the revenue and expenditures for a fiscal year and breaks down expenses by function. It also includes information on net assets released from restrictions and lists the organization’s net assets at the beginning and end of the year. The Statement of Activities helps stakeholders understand the financial performance of the nonprofit and how funds are being utilized.

Statement of Cash Flows

The Statement of Cash Flows is a financial report that shows how money flows in and out of a nonprofit organization regularly. It provides a detailed breakdown of the organization’s cash receipts and payments over a specified period. This statement is essential for stakeholders as it helps them understand the organization’s liquidity and cash management. The key components of a strong cash-flow statement include:

- An accurate balance sheet, which represents the difference between assets and liabilities.

- A detailed description of all cash receipts and payments, including the type of payment and when they occurred.

- An explanation of why each category is included in the statement.

- Clear explanations of any non-cash adjustments used to improve reported results, such as depreciation.

By analyzing the Statement of Cash Flows, stakeholders can gain insights into the organization’s financial health and its ability to meet its short-term obligations. It also helps them assess the organization’s cash flow management and make informed decisions regarding funding and investments.

Implications of Net Assets for Stakeholders

Donors and Funders

Donors and funders play a crucial role in the success of nonprofit organizations. Their contributions provide the necessary financial support for these organizations to carry out their missions and make a positive impact in the community. Donors are individuals or entities who voluntarily give money or resources to support a nonprofit’s activities. Funders, on the other hand, are organizations or institutions that provide grants or sponsorships to fund specific programs or projects.

It is important for nonprofit organizations to cultivate strong relationships with their donors and funders. This involves effective communication, transparency, and accountability. Nonprofits should keep their donors informed about the impact of their contributions and how their support is making a difference. Regular updates and reports can help donors feel connected to the organization’s mission and motivated to continue their support.

In addition to financial contributions, donors and funders can also provide valuable expertise, networks, and resources to nonprofit organizations. They can offer guidance and advice on strategic planning, fundraising strategies, and program development. Collaborating with donors and funders can lead to innovative partnerships and opportunities for growth and sustainability.

Tips for Nonprofits:

- Express gratitude: Show appreciation for donors and funders through personalized thank-you notes, recognition events, or public acknowledgments.

- Provide impact reports: Share stories, testimonials, and data that demonstrate the positive outcomes and impact of the organization’s work.

- Foster relationships: Regularly communicate with donors and funders, keeping them updated on the organization’s progress, challenges, and future plans.

- Seek feedback: Ask for input and feedback from donors and funders to improve the organization’s programs and operations.

Remember, donors and funders are essential partners in the nonprofit sector. Their support and engagement contribute to the sustainability and success of nonprofit organizations.

Board Members

Board members play a crucial role in nonprofit organizations, providing oversight and guidance for the organization’s mission and financial stability. Clear and frequent communication on financial matters is essential for board members, especially those who may not have a background in accounting. Regular and accurate financial reports are vital for board members to make informed decisions and ensure the organization’s financial health. It’s important for nonprofits to work with accounting firms that understand their unique challenges and can provide specialized services tailored to their needs.

At Chazin & Company, we specialize in nonprofit accounting and offer outsourced accounting, CFO, and advisory services. Our team is dedicated to empowering nonprofits in fulfilling their missions and achieving their strategic goals. Contact us today to discuss your organization’s financial needs and how we can support you.

Frequently Asked Questions

What are net assets?

Net assets refer to the disparity between what a nonprofit organization owns and owes. Unlike for-profit businesses, nonprofits have no owner’s equity or retained earnings.

How are net assets calculated?

Net assets are calculated by subtracting total liabilities from total assets.

What are the types of net assets?

The types of net assets include unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets.

Why are net assets important in nonprofit organizations?

Net assets are important because they reflect the financial stability and resources available to a nonprofit organization. They also play a role in financial reporting and decision-making.

What is the role of net assets in financial reporting?

Net assets are reported in the Statement of Financial Position, Statement of Activities, and Statement of Cash Flows. They provide information about the organization’s financial health and resource allocation.

How do net assets impact stakeholders?

Net assets impact stakeholders such as donors and funders, board members, employees, and volunteers. Donors and funders may consider the organization’s net assets when making funding decisions, while board members rely on net assets for financial oversight and decision-making.