Opening A Nonprofit Bank Account: When & How – 8 Things

Disclaimer: This post may contain affiliate links. These links, if used and purchases made, we may earn a small commission. These affiliate programs do not impact the recommendations we make or the resources we refer you to. Our focus is on providing you the best resources for your nonprofit journey.

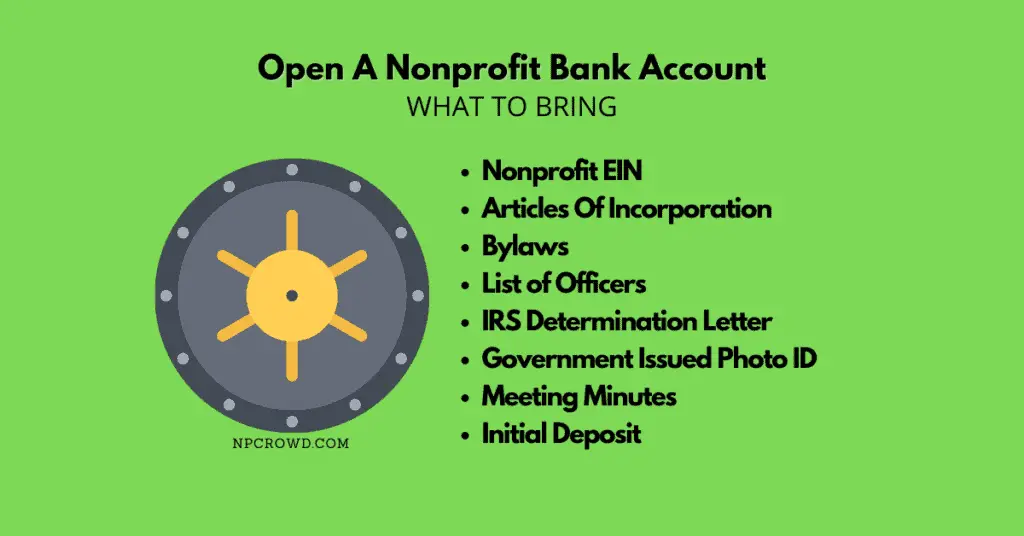

It’s time to open a bank account for your nonprofit. But, what do you need before you can do it? We’re here to help.Opening a bank account for a nonprofit is best achieved by bringing the following 8 items: the nonprofit EIN, incorporation documents, Bylaws, IRS determination letter, meeting minutes, government photo id, a list of officers, and the monies for the initial deposit.

There is more to opening a nonprofit bank account than simply bringing the right documents. Let’s explore when you can open a nonprofit back account, what you need, and what you might consider when selecting a bank.

Let’s get into it.

How Do I Open A Nonprofit Bank Account

Opening a nonprofit bank account is not difficult. However, like any other business bank account for a corporation, each bank’s process will be a little different. Let’s look at the standard steps to opening a nonprofit bank account.

- Select the bank – Identify the bank that you wish to use. We have suggestions on how to choose a bank further below.

- Call ahead and make an appointment – Talk to a banking executive and make an appointment to open the account. This allows the start of a personal relationship with a banker and you will know what you need to bring.

- Gather required documents – Typically you’ll want to bring your government issued photo id, IRS Letter of Determination, incorporation documents, copy of Bylaws, Board meeting minutes, EIN, list of officers, and the initial deposit funds.

- Meet the Banker – Use this time to share the story of your nonprofit with the bank and get to know eachother. Also learn about any special services available to nonprofits at the banking institution.

- Complete the paperwork – This one is self-explanatory. Be sure your Treasurer is with you if needed. This is when signature cards will also be signed or receive for later signing and return.

- Select your first set of checks – Select the business checks that are most appropriate for initial use. Your bookkeeper or accountant might want to have a say in this.

- Get online access to your accounts – This wil lhelp you, your treasurer, or accountant to keep tabs on your account and receive electronic statements early each month.

- Make your initial deposit – Be sure you are meeting all account minimums to avoid additional fees. This is part of being a good steward of your nonprofit funds.

Remember, it is best to open your nonprofit bank account only after you’ve completed all other steps of the startup checklist. Your Board meeting minutes will have reflected that you have been authorized by the Board to open the account(s) and who has access to them.

What do I need to open a business bank account?

To open a nonprofit business account, you will need 8 items to make the process smooth.

- Nonprofit EIN – The EIN you obtained from the IRS.

- Articles Of Incorporation – To be safe, bring these and any other business registration/incorporation document from the state.

- Bylaws – The adopted Bylaws of the nonprofit and the meeting minutes that reflect their adoption by the Board.

- List of Officers – A list of your Board officers and key executives including name, title, and contact information.

- IRS Determination Letter – This allows the account to be tax exempt and may entitle your organization to special bank benefits as a nonprofit.

- Government Issued Photo ID – Driver’s license and Passport are good options.

- Meeting Minutes – Copies of the meeting minutes that show the adoption of the Bylaws and your authorization by the Board to open the bank account(s).

- Initial Deposit – Bring the funds that will be used as the initial deposit the exceeds the minimum balance needed for the account(s) being opened.

Why Not To Open A Nonprofit Bank Account Before IRS Determination Letter

One question we hear from time to time is whether you really have to wait to open a nonprofit bank account until the IRS determination letter is received. Technically, you do not have to wait on the determination letter to open the account. However, if the tax-exempt status of the nonprofit is not received or is denied, you may be personally held responsible for the taxes on those monies in the account.

We recommend waiting until the IRS Determination Letter officially makes your organization tax-exempt before doing any fundraising or opening accounts with financial institutions.

There are ways to deal with this retroactively but you will likely want to use a legal firm to handle your IRS Form 1023 filing to handle a retroactive exemption.

What Type Of Bank Account Is Best For Nonprofits?

Nonprofits can use any type of banking account as any other corporate. Options include but are not limited to checking, savings, and money market accounts. Endowments are another type of account for use in specific circumstances.

I most typically see nonprofits utilize a business checking account and a business savings account. The checking account is used for operational income and expenses. The savings account is used for building up operating reserves.

Can A Nonprofit Have Multiple Bank Accounts?

Nonprofits can have multiple bank accounts with multiple financial institutions. In fact, for accounts with more than the FDIC insured amounts in them, you may want to consider splitting funds into other banking institutions.

Another reason to utilize more than one bank over time is to build community relationships with multiple bank executives by keeping deposits in multiple banks.

Considerations For Selecting A Bank For Nonprofit Accounts

When selecting a bank for your nonprofit checking and savings accounts, there are a few considerations to review before settling with a big bank chain name.

Banking Services

First, identify the services/features you need from a bank, not just today, but in the coming years.

Discuss features and services such as:

- Online banking

- Online statements / Paper statements

- Corporate Credit Cards

- Fraud protection / Insurance

- Travel Miles programs

- Insurance / Roadside Assistance

- Expense Reimbursement / Management tools

- Accounting System Imports

- Wire Transfers (Debit/Credit)

- ACH Payments

- Online Bill Payment / Schedule

- Integration with online bill pay tools (Quickbooks Online, Xero, RelayFi)

- Two-Signature Checks

Banking Fees

Banks make money on the fees they charge. More so in today’s environment where some banks actually charge a fee to talk to a real person rather than on an online chat. Go figure!

Alternatively, some banks offer discounted or a complete waiving of fees for nonprofits. Ask! Local banks tend to be more generous to nonprofits in this way than some of the big national chains. See if you can find a local bank that has the services you need and does not charge fees to nonprofits.

Some typical fees to investigate include:

- Online banking – is it an extra cost?

- Paper statements – Do they charge a fee for paper statements?

- Stop payments – Is there a fee to stop payment on a check your nonprofit writes?

- Bill pay – Does it cost extra to use their online bill pay system?

- Corporate Credit Cards – Interest rate and extra fees

Banking Interest

This is a topic that requires a little bit of thinking. We want to find the best opportunity for money we keep in all our accounts to earn interest while the money is sitting there.

Check out and compare business checking and savings account interest rates between several banks. Many times the banks with the highest interest rates that also have the services we need and discount fees for nonprofits may be the best fit for your first accounts.

While this is indeed something to review, you may that the bank with the best interest rate is not the best fit for your nonprofit. Weigh all the options before deciding.

Banking Relationships

Believe it or not, local banks and bank branches tend to be well connected to the community you serve. Many banks even provide grants or donations to local nonprofits, although these are typical “hat tip” amounts.

At the same time, I’ve seen bank executives become personally invested in a nonprofit that has an account with them and turn around to donate significantly as an individual.

Like all major donor fundraising, it’s about relationships. Bank execs also tend to be well connected and can introduce you and your nonprofit to others in their circles of influence.

Keeping the right bank relationships can lead to fundraising opportunities while also providing the necessary fiduciary services.

Best Banks For Nonprofit Accounts

As we mentioned above, check with local, non-national banks in your area while also reviewing regional or national banks.

We’ve come across a few regional and national banks that are indeed friendly to nonprofits. I hope his list helps you narrow down where to open your nonprofit bank account.

| Bank Name | Nonprofit Account Holder Benefits |

|---|---|

| PNC Bank | – Nonprofit specific accounts – Free 150 transactions/month – PNC Foundation gives back to certain nonprofits in a “give back” sort of way |

| US Bank | – Nonprofit specific checking account – Free 150 transactions/month – Free 25 deposits/month – Interest bearing account options – Business debit card – Bill Pay – Remote check deposit |

| BMO Harris Bank | – Nonprofit specific starter account – Free 200 transactions/month – Free Deposits up to $5,000/month – Remote check deposit – Bill Pay – No maintenance fees |

| TIAA Bank | – Nonprofit specific accounts – Free 10 Bill payments/month – No maintenance fee (balance > $5,000) – CAREFUL – Does not include the free 200 items/month that Business Checking includes |

| M&T Bank | – Many East Coast States – Nonprofit Checking account – Waived fees when average balance > $500 – Free 50 items/month |

| Old National Bank | – Illinois, Indiana, Kentucky, Minnesota, Wisconsin, Michigan – Free 500 items – Unlimited deposits – No maintenance fee |

| American National Bank | – Nebraska, Iowa, Minnesota region – Nonprofit specific accounts – Free 300 items/month – Discounted fees and services – Community investment and in-kind donations |

| Southside Bank | – East Texas region – No Nonprofit specific accounts – Fees can be waived for select nonprofits – Personal experience is very nonprofit friendly |

| PeoplesBank | – Massachusetts/Connecticut region – Nonprofit specific accounts (Low or high transaction volumes) – Free 250 Deposit items/month – Free 250 Checks/month – No maintenance fee – ACH Origination – Remote Deposit Capture |

| First Service Credit Union | – Houston, Texas area – Free 100 transactions/month – No maintenance fee – No minimum balance |

| Coastal Community Bank | – Seattle, WA area – Free 125 transactions/month – Free deposits up to $10,000/month – No Minimum balance |

Wrap Up

Opening the bank accounts for a nonprofit is one of the final steps in starting a new nonprofit. Don’t do this too early or you may become liable for taxes on all monies received. Keep our tips in mind for consideration in selecting a financial institution. Finally, be sure to bring the right people and documents with you when it is time to open the accounts and the process is quick and straightforward.

How To Start A Nonprofit Next Steps

Compensation questions coming up? Be ready.

Whether it is a board review, a new hire, an audit, or someone browsing your 990 – ExemptPay helps you respond with data. Explore free salary benchmarks from 3M+ Form 990 records, then generate a Board Confidence Report with peer group analysis and minutes-ready language your board can act on.